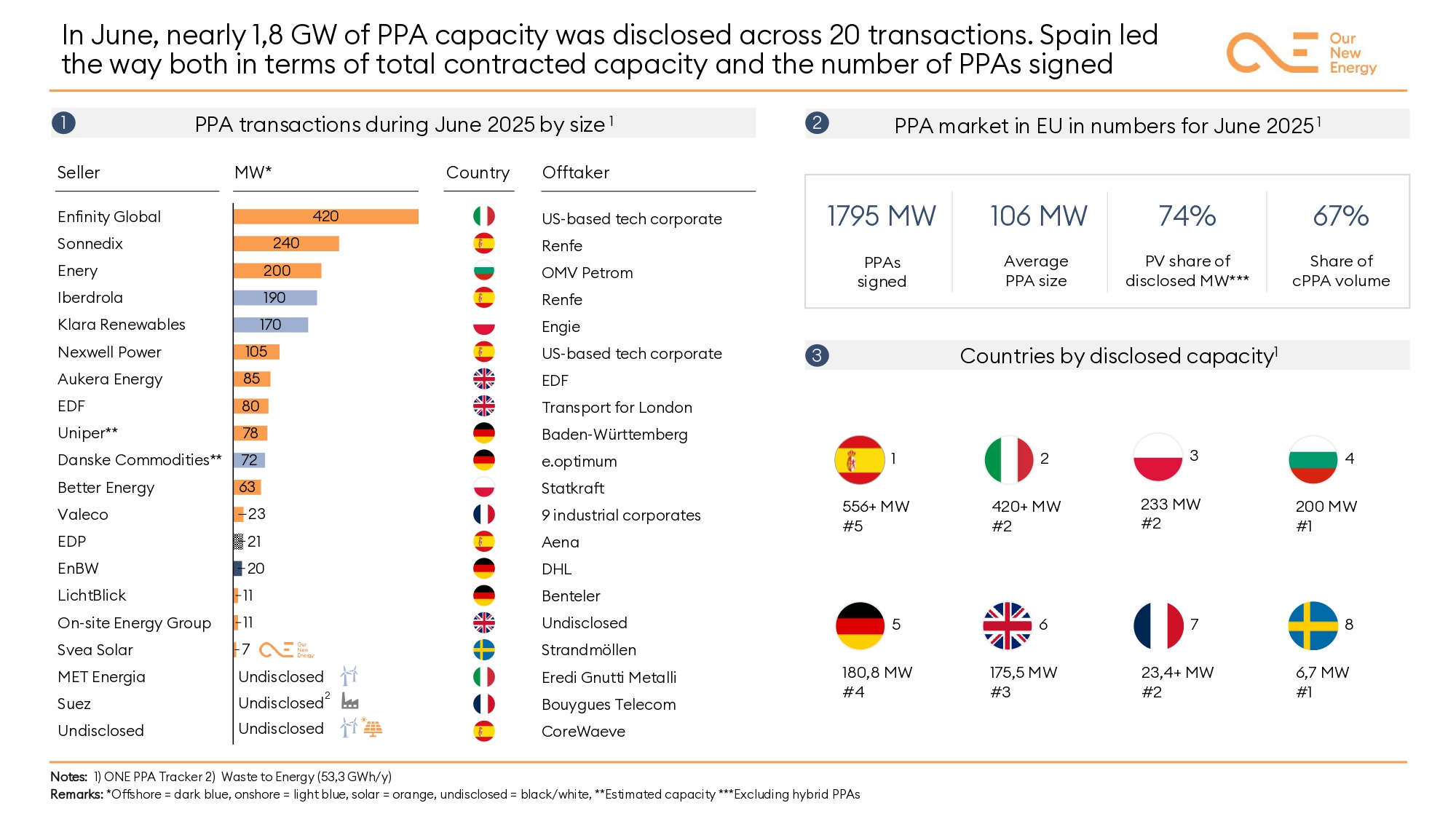

In June 2025, the European PPA market reached 1.8 GW of contracted capacity across 20 deals, according to the monthly report by One Insights. With these results, the cumulative figure for the first half of the year stands at 6,624 MW across 134 agreements across Europe.

Spain emerged as the leading country both in the number of transactions and total capacity signed, consolidating its central role in the dynamism of the continental market.

Technologically, solar PV led the market once again, accounting for 74% of the contracted capacity. Meanwhile, corporate PPAs made up 67% of the volume, confirming the continued dominance of this mechanism in long-term energy contracting in Europe.

Monthly evolution of the PPA market in H1 2025

Monthly data from the One Insights (Our New Energy – ONE) reports shows significant fluctuations in deal flow across the semester:

- January: 25 deals totalling 756 MW, with 32% from solar and 67% corporate PPAs.

- February: 28 deals for 1,233 MW, with 62% solar and 87% corporate contracts.

- March: 23 deals for 1,040 MW, 64% solar and 89% corporate PPAs.

- April: 24 deals for 1,450 MW, onshore wind grew to 61% while corporate PPAs dropped to 64%.

- May: just 14 deals and 350 MW, 100% corporate and 52% solar.

- June: rebound with 20 deals and 1,795 MW, 74% solar and 67% corporate.

In an interview with Strategic Energy Europe, ONE’s Managing Director, Miguel Marroquín, asserts: “It can’t get worse than this semester,” referring to the limited market dynamism.

The fear surrounding captured prices for solar in southern Europe and for wind in the north has been identified as the main reason for the slowdown.

The analyst explains that captured prices were “extremely low” in H1 2025, ranging between 20% and 30% of the baseload value, significantly impacting buyer decision-making.

“There comes a point where demand can’t absorb such a surplus. That leads to price holes, and if you want PPA certainty, the discount you must accept is considerable,” states the Our New Energy executive.

This has led to a more restricted primary market, with fewer deals compared to H1 2024.

However, the expert remains optimistic for the second half of the year and foresees a structural shift with the rise of hybrid contracts.

Contracts combining technologies such as solar-wind or solar with storage are gaining ground as a viable solution to diversify risks and improve captured price ratios.

Although currently under negotiation, Marroquín affirms that these will be signed before the first quarter of 2026.

“It’ll be a novelty to speak of PPAs where companies merge wind and solar portfolios instead of managing them separately,” he notes, highlighting that firms are leaning towards managing these combinations under a single entity.

Looking ahead to 2026, a recovery is anticipated, driven by the emergence of new regulatory signals, the advancement of hybrid PPA structures, and the inclusion of the first storage projects in “Ready to Build” status. According to him, these factors could mark a turning point and reignite market activity after the H1 2025 slowdown.

Nevertheless, he warns that the market urgently requires structural reform to regain functionality and ensure sustainable investment conditions, stressing that “the only solution is to redesign the market”.

Market design debate

Marroquín points out that in countries such as Spain, over 25 GW of awarded capacity with grid access is ready for development but lacks financial viability due to weak price signals. He questions the validity of public auctions as true market indicators and argues that the current marginalist system deepens distortions by allowing zero-price bids.

Against this backdrop, three alternatives are being discussed. One, mentioned but not endorsed by Marroquín, involves implementing capacity mechanisms or contracts for difference (CfDs), which he argues simply inflate installed capacity and further depress marginal prices.

Another option is to decouple natural gas from the price-setting mechanism. However, the executive also rejects this approach, stating that it fails to tackle the root structural problem.

Lastly, Marroquín advocates for introducing minimum participation prices per technology, based on LCOE (levelised cost of energy). For instance, solar should not be allowed to bid below €30/MWh. He argues this would restore realistic price signals, support investment planning, and reignite PPA demand across Europe.

ONE Insights – PPA market update junio 2025

One Insights - PPA market update June 2025 (1)