1st October 2025 will be remembered in the history of the Spanish electricity sector, as the daily market auction abandoned hourly prices in favour of quarter-hourly values, quadrupling the system’s resolution.

What was previously measured in 24 daily prices is now broken down into 96, aligning for the first time the entire market chain — from the main auction to imbalances — within the same granularity.

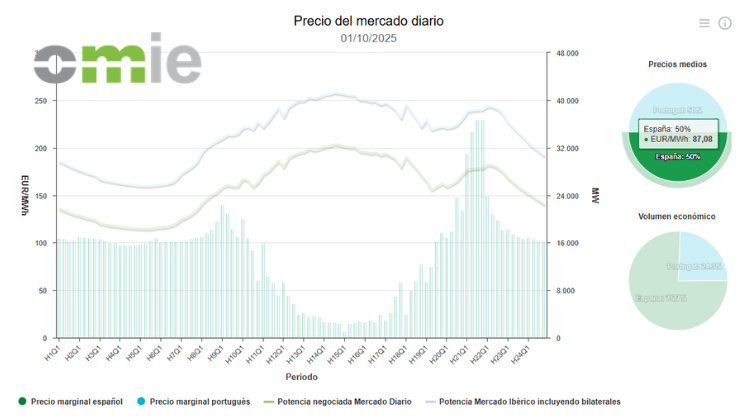

The first session showed the volatility that can arise within minutes: the minimum price was set at €6.67/MWh between 15:00 and 15:15, while the maximum reached €230/MWh between 21:30 and 22:00. In just one hour there were collapses of more than €65/MWh, while in other slots the differences were almost non-existent. The message is clear: every quarter of an hour counts.

The new system has a direct impact on heavy industry and consumers with power demand above 50 kW, whose meters already measure in 15-minute blocks. For them, billing will reflect the exact value of each slot. “A plant that previously scheduled its start-up at 7:00 because the whole hour was cheap can now shift it to 7:45 if that quarter is more economical. Optimisation ceases to be approximate and becomes surgical,” said Aníbal Martín Rolla, Energy Consultant at FEBO Energía, in conversation with Strategic Energy Europe.

From the solar perspective, the outlook is positive though cautious. Cristina Torres-Quevedo, Chief Financial and Regulatory Officer at UNEF, explained that “the quarter-hourly market will provide companies with a more precise price signal and reduce deviations between programmed and actual generation. We believe it is good for generators and for the system, although it is still too early to measure its impact.” In her view, this dynamic also opens the door to more active management strategies for solar assets, with the possibility of clearing more operations at certain times and improving profitability in scenarios of greater volatility.

The shift to quarter-hourly prices also represents a challenge for operators: the daily market’s data volume increases fourfold. Forecasting models, remote metering and optimisation software become indispensable for retailers and aggregators that must operate with clockwork precision.

“Margins of error are reduced to a minimum. Companies that do not adapt their forecasting models and demand management will be taking on unnecessary risks,” warned Rolla, emphasising that the key is no longer simply accessing the average price, but taking advantage of the full curve of peaks and troughs.

The other side of the change lies in the opportunities it creates for storage and demand management. Batteries charging during cheap slots and discharging during expensive ones, industrial processes shifted by just a quarter of an hour to save thousands of euros a year, and aggregators packaging flexibility into marketable products all find fertile ground in this new framework. “With this system, flexibility ceases to be a secondary resource and becomes the central asset of the system,” Rolla concluded.

The measure responds to a European obligation under the CACM Regulation. Spain joins the continental trend towards more granular markets, an essential step for integrating intermittent renewables and reinforcing security of supply.

The launch of the quarter-hourly market is not simply a calendar change. It is a new playing field where competitiveness will depend on the ability to manage data, anticipate prices and mobilise flexibility in real time. Those who act first will capitalise on the transition; the rest will adapt later, probably at greater cost.