The Association of Energy-Intensive Companies (AEGE) presented its latest update to the Energy Barometer , a tool that analyzes the evolution of industrial electricity bills in Europe and the impact of energy prices on electro-intensive sectors.

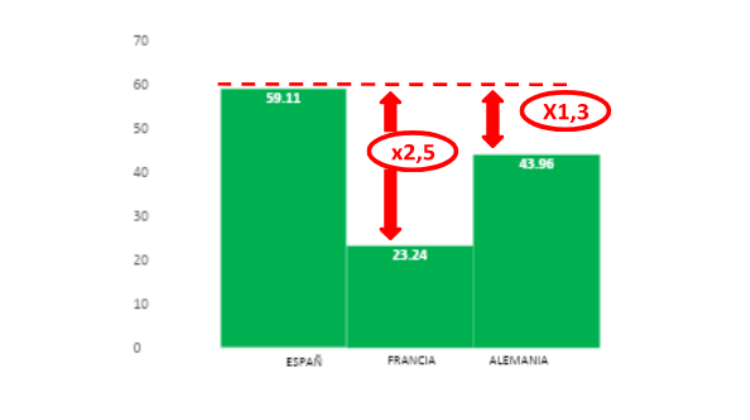

The report warns that Spanish industry faces costs far higher than those of its main European competitors: the price of electricity is 2.5 times higher than in France—where the ARENH tariff allows 62% of the supply to be contracted at regulated prices of €42/MWh—and 34% more expensive than in Germany.

Added to this are higher payments for adjustment services and lower CO₂ offsets, which further strain the competitiveness of the national industry compared to its EU counterparts.

In order to contribute in a simple and objective manner to the dissemination of the evolution of industrial energy costs, the AEGE barometer shows the prices of the national spot and forward electricity markets and the main European electricity markets, as well as the price evolution of other relevant segments of the final electricity bill paid by industrial consumers, such as adjustment services, tolls, charges, and taxes. The price of demand-side management services and indirect CO2 offsets are also discounted .

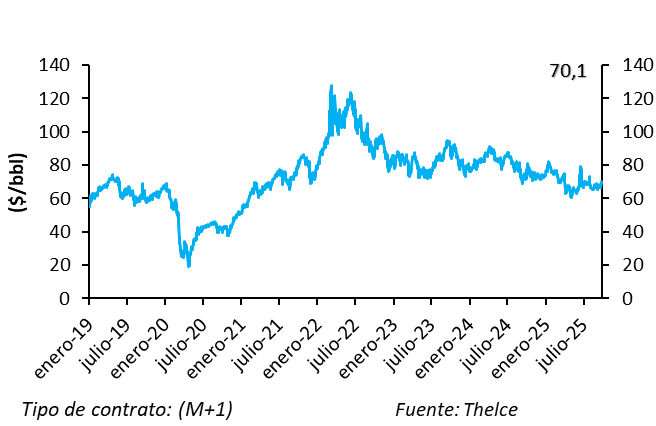

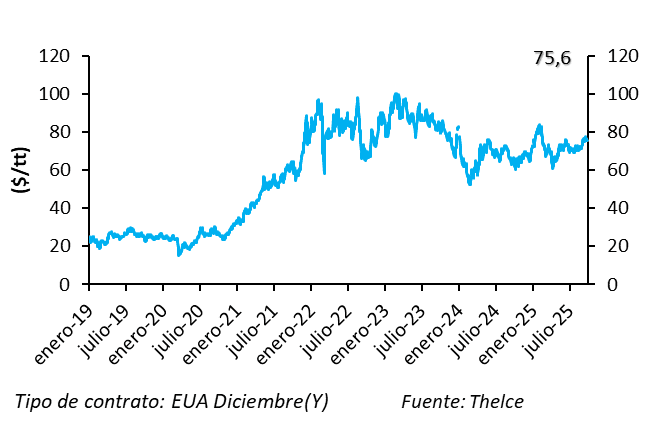

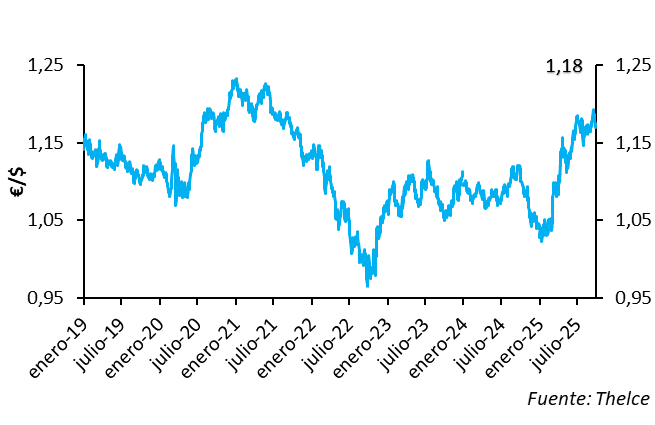

Finally, the prices of the main fuels or commodities in the energy sector are shown, such as the price of a barrel of Brent crude, API#2 coal, the European reference natural gas market (TTF), and CO2 emission rights , all of which influence the final electricity market price to a greater or lesser extent. The information presented in the barometer is updated weekly.

Chart 1. Comparison of final electricity prices in the electro-intensive industry in 2025 (€/MWh)

TABLE 1. COMPARISON OF FINAL ELECTRICAL PRICES IN THE ELECTROINTENSIVE INDUSTRY IN 2025 (PHOTO AS OF 08/31/25)

| €/MWh | SPAIN | FRANCE | GERMANY | |||||

| 2025 | Rate 6.4 | Tarifa HTB3 (350kV – 500kV) | MAT Tariff (380kV of 220kV) | |||||

| MARKET (1) | 65,75 | 50,55 | 89,98 | |||||

| ADJUSTMENT AND OTHER SERVICES | 17,00 | 0,00 | 0,00 | |||||

| ACCESS TOLLS (2) | 2,81 | 1,04 | 6,98 | |||||

| FEES AND TAXES (3) | 4,36 | 0,95 | 1,30 | |||||

| DEMAND MANAGEMENT | -6,20 | -2,50 | -3,40 | |||||

| INDIRECT CO 2 (4) | -24,60 | -26,80 | -50,90 | |||||

| COSTE FINAL (€/MWh) | 59,11 | 23,24 | 43,96 | |||||

| Consumption: 500GWh/year. | ||||||||

| (1) This value is the composition of the average market value to date with the average of the futures for the rest of the year. | ||||||||

| (2) Network tolls + losses | ||||||||

| (3) Taxes for Spain: Electricity Tax (IE) + Municipal Tax (TM) + National Energy Efficiency Fund (FNEE). VAT is not included in any case. | ||||||||

| (4) For France, the offsets provided for in the European indirect CO2 regulations for 2025 are limited to 75%. In Germany, additional offsets above 75% are permitted, the so-called supercap. For Spain, the offset is €600 million. | ||||||||

Table 2. EVOLUTION OF THE AVERAGE DAILY MARKET PRICE (2015-2025)

Source: Epexspot, OMIE, OMIP, Own elaboration.

Source: Epexspot, OMIE, OMIP, Own elaboration.

(*) Cumulative average of the Spot up to the update date, completed with immediate futures until the end of the year.

FUNDAMENTALS

Data updated as of 09/30/25

EVOLUTION OF THE PRICE OF COAL

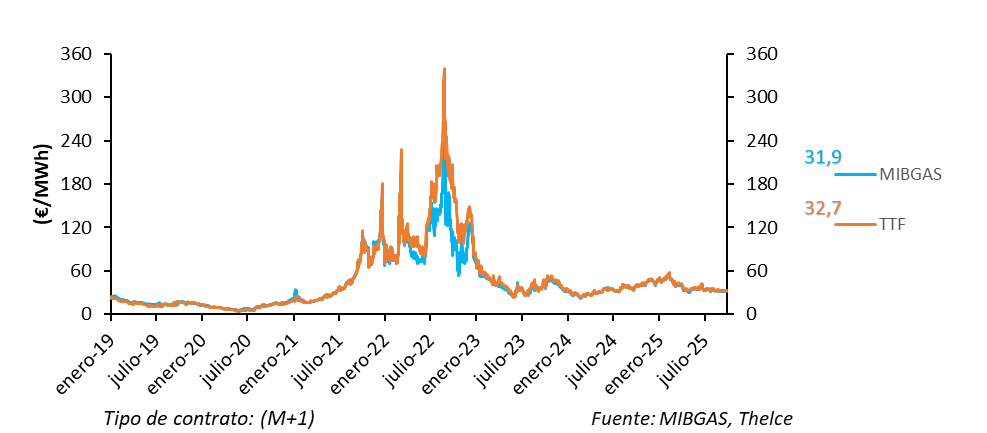

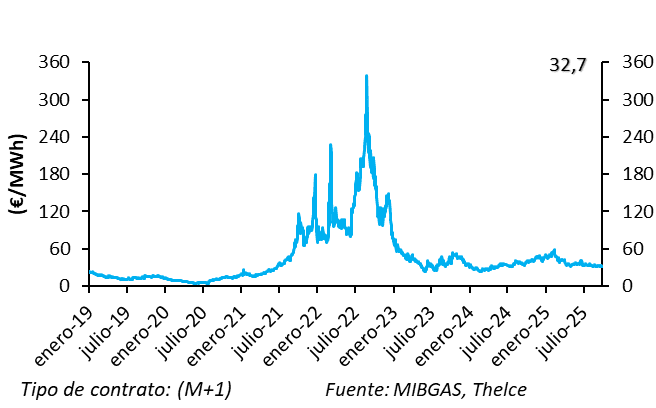

EVOLUTION OF THE PRICE OF NATURAL GAS

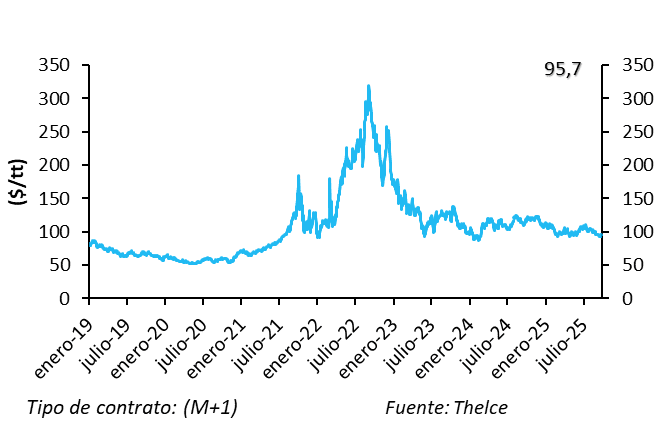

EVOLUTION OF THE BRENT PRICE

EVOLUTION OF THE PRICE PER TON OF CO 2

EXCHANGE RATE EVOLUTION $/€

EVOLUTION OF NATURAL GAS MIBGAS – TTF