AleaSoft Energy Forecasting. During the second week of July, average electricity prices in most major European markets fell compared to the previous week, although in almost all cases they remained above €75/MWh.

France and Italy recorded their highest-ever daily solar photovoltaic generation, while Spain reached a record high for a July day. Lower demand due to milder temperatures also exerted downward pressure on prices.

Solar and Wind Generation

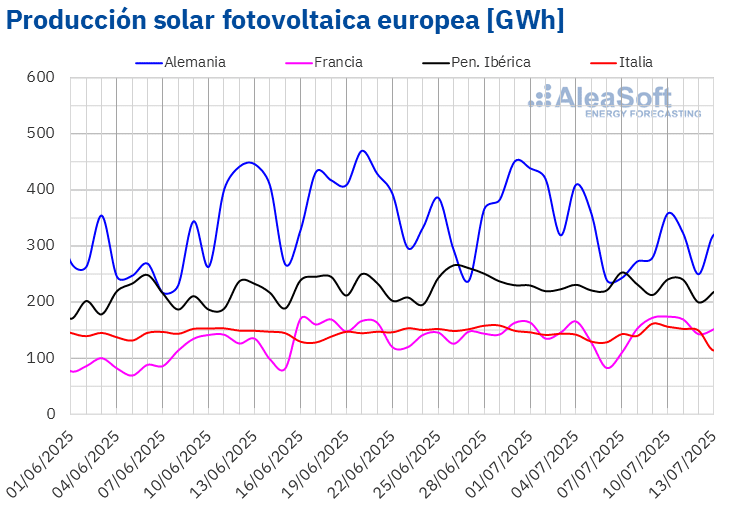

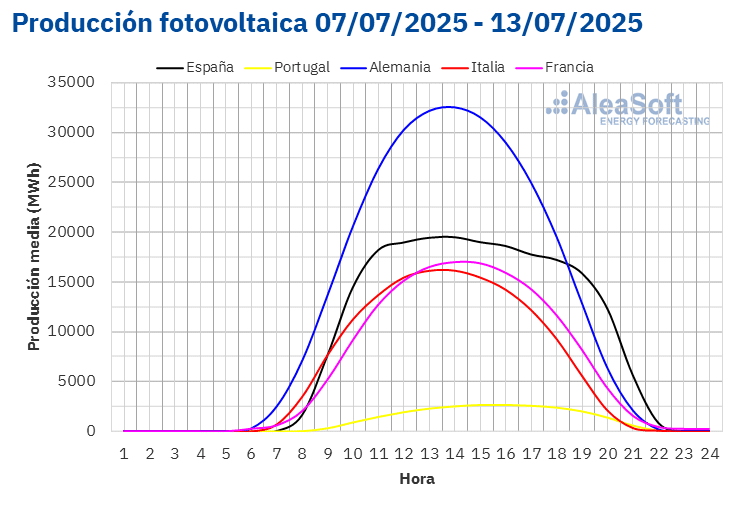

During the week of 7 July, solar photovoltaic generation increased in France, Italy, and Spain compared to the previous week. France maintained an upward trend for the second consecutive week, with the largest growth of 9.1%.

Italy and Spain reversed the declines of the previous week, with increases of 3.7% and 3.3%, respectively. Conversely, Germany and Portugal saw a reversal of the previous week’s growth, with declines of 22% and 13%.

France and Italy reached historical solar production records during the week. On 10 July, France recorded its highest-ever solar generation at 173 GWh. Italy followed on 9 July with a record 161 GWh. Spain achieved its highest solar output for a July day on 7 July with 224 GWh.

For the week of 14 July, AleaSoft Energy Forecasting anticipates increased solar production in Germany and Spain, while Italian output is expected to decline.

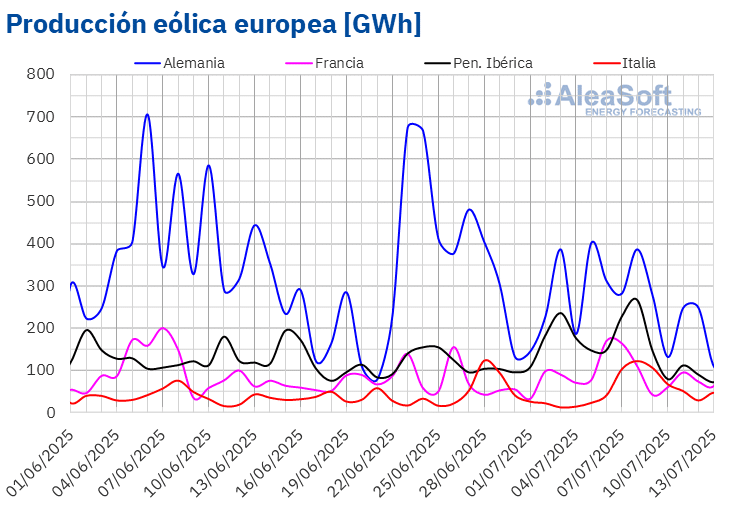

Wind generation increased week-on-week in Italy and France. Italy saw the highest rise, up 191%, reversing the previous week’s fall. France posted a 2.2% increase, continuing a four-week upward trend.

Meanwhile, Spain and Portugal registered the sharpest declines, at 9.2% and 8.8%, respectively. German output fell 6.0%, its second consecutive weekly drop.

Looking ahead to the week of 14 July, AleaSoft forecasts mixed wind production trends. Output is expected to rise in France and Portugal but decline in Germany, Spain, and Italy.

Electricity Demand

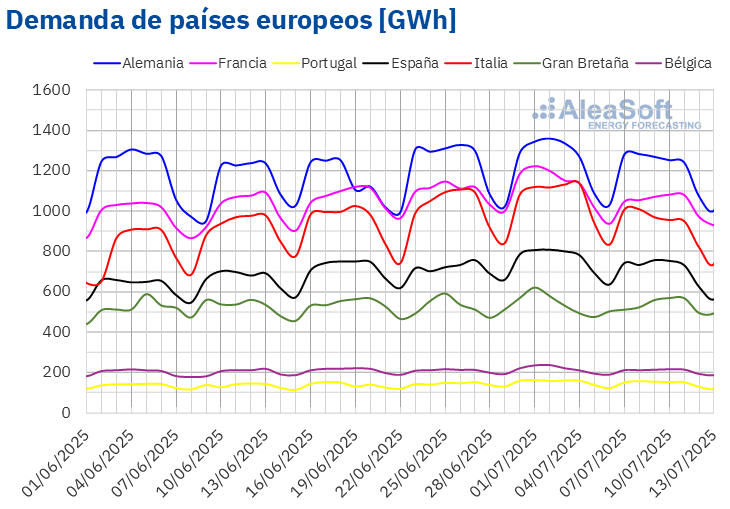

Electricity demand declined in most major European markets during the week of 7 July, reversing the upward trend observed the previous week.

After six consecutive weeks of growth, Italy recorded the sharpest drop at 12%. Other markets saw declines ranging from 1.3% in Great Britain to 7.8% in France.

Average temperatures decreased in most analysed markets, reducing cooling needs and thus electricity consumption. Temperatures fell by 2.3°C in Spain and 4.5°C in Germany. However, the UK saw a 1.0°C increase.

For the week of 14 July, AleaSoft forecasts rising demand in Italy, Spain, and the UK, while Belgium, Portugal, and Germany will see continued decreases. French demand is expected to remain steady.

European Power Markets

Average electricity prices declined in most major European markets during the second week of July. Exceptions included the UK’s N2EX and the Nord Pool market, with increases of 9.9% and 67%, respectively.

France’s EPEX SPOT market saw the largest percentage drop at 34%. Other markets experienced price reductions ranging from 5.1% in Germany to 16% in Spain.

Despite the decreases, weekly averages remained above €75/MWh in most markets. Exceptions were the Nordic (€33.54/MWh) and French (€49.96/MWh) markets. Italy’s IPEX posted the highest weekly average at €108.38/MWh. Other markets ranged between €77.28/MWh (Spain) and €91.51/MWh (UK).

On a daily basis, the lowest price was in the Nordics on 13 July at €16.99/MWh, while the highest was in Italy on 7 July at €118.27/MWh. Italian prices remained above €100/MWh throughout the week, with the Iberian market exceeding that threshold on 10 July.

Price declines were driven by reduced demand and increased solar output. Wind generation in France and Italy also contributed.

AleaSoft forecasts price increases in the third week of July in most markets, driven by lower wind generation and higher demand in some regions.

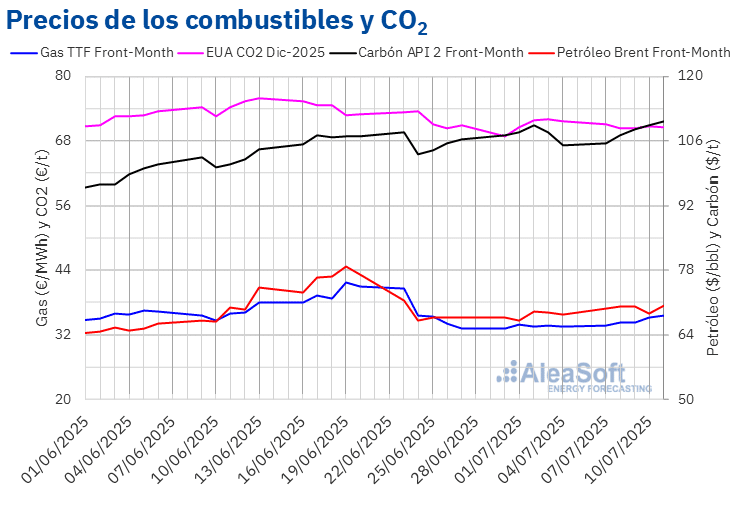

Brent, Fuels and CO2

Brent crude futures for the Front-Month on the ICE market mostly trended upwards during the second week of July, except on 10 July, when they dropped by 2.2% to $68.64/bbl. Prices peaked on 11 July at $70.36/bbl, 3.0% higher than the previous Friday.

Despite OPEC+’s announcement of increased output in August, Brent prices were buoyed by Red Sea attacks, higher Saudi prices for Asia, and the prospect of new sanctions on Russian oil.

Concerns over US tariff policies continued to weigh on global demand sentiment. Talks of pausing October production hikes and rising US inventories also influenced prices downward midweek.

TTF gas futures reached a weekly low of €33.62/MWh on 7 July and rose to €35.56/MWh on 11 July, a 6.3% increase from the previous week. Asian heatwaves boosted demand, potentially limiting LNG supply to Europe.

CO2 futures (Dec 2025) on the EEX peaked at €71.20/t on 7 July but fell to a weekly low of €70.41/t on 9 July. By 11 July, the price closed at €70.55/t, 1.6% below the prior Friday’s level.