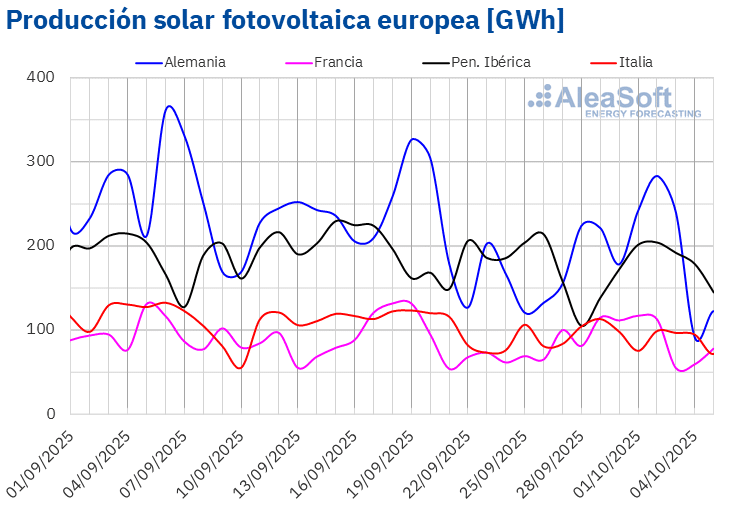

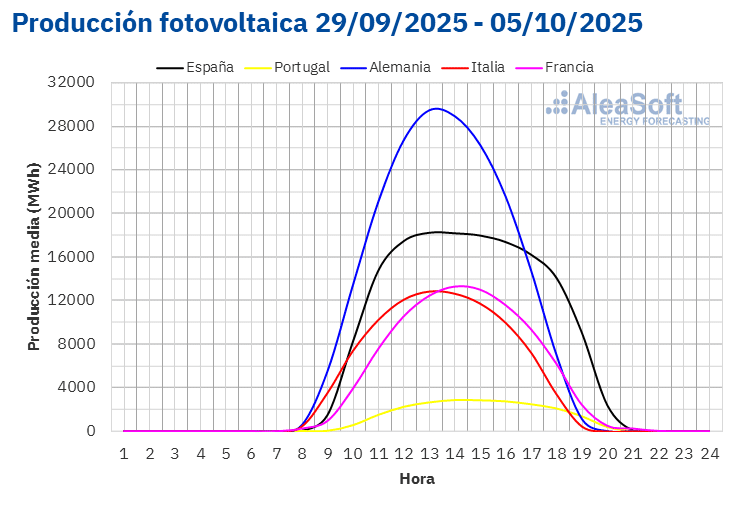

During the week of September 29, solar PV production increased in most major European electricity markets compared to the previous week. The French and German markets recorded the largest increases, 25% and 22%, respectively. Italy recorded the smallest increase, 7.1%, and Portugal rose 8.0%, following two weeks of declines. In contrast, the Spanish market recorded a decline for the second consecutive week, this time of 3.4%.

During the week, major European markets reached all-time highs in photovoltaic production for a single day in October. The French market recorded its record on October 1, with a generation of 117 GWh. The following day, October 2, the German, Spanish, and Italian markets reached their records, generating 283 GWh, 181 GWh, and 98 GWh, respectively. The Portuguese market reached its record on Friday, October 3, with a generation of 23 GWh.

During the second week of October, AleaSoft Energy Forecasting ‘s solar production forecasts expect increases in the Italian and Spanish markets, while the German market will experience a decrease in production with this technology.

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

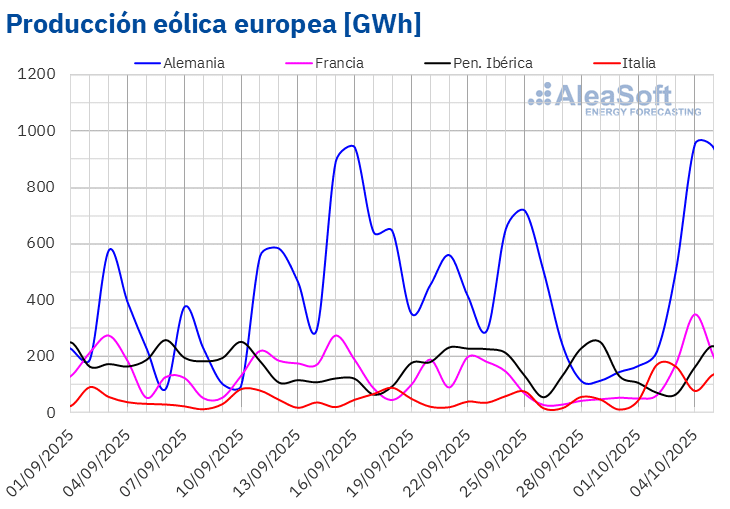

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.During the first week of October, wind power generation increased in most major European electricity markets compared to the previous week. The Italian market recorded the largest increase, 119%, while the German market saw the smallest increase, 3.9%. France recorded a 36% increase, after three weeks of declines. In contrast, markets on the Iberian Peninsula showed declines in wind power generation. The Spanish market registered a drop of 8.7% and the Portuguese market, 40%.

This week, the Italian, German, and French markets reached historic wind production records for a single day in October. The Italian market recorded its highest daily production on Thursday, October 2, with 171 GWh of generation. The German and French markets reached their highest daily production for October on Saturday, October 4, with 953 GWh and 349 GWh, respectively.

In the second week of October, according to AleaSoft Energy Forecasting ‘s wind energy production forecasts , wind energy production will decline in most of the main European electricity markets.

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.Electrical demand

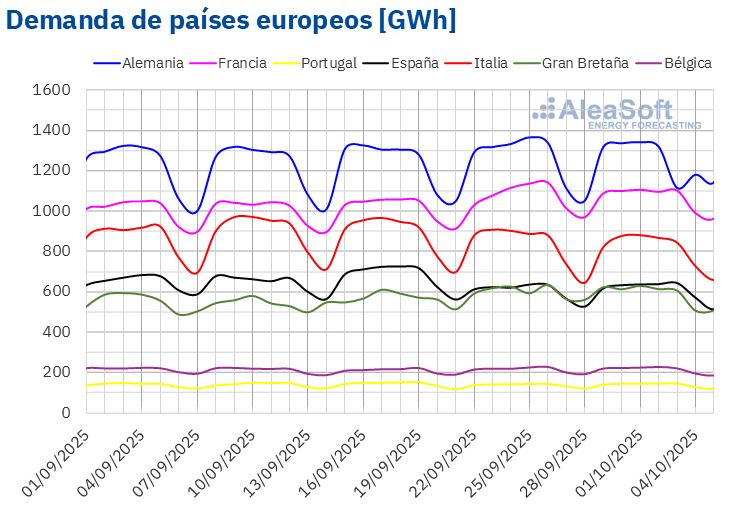

In the first week of October, electricity demand increased in the Iberian Peninsula compared to the previous week. The Portuguese market registered the largest increase, 1.0%, despite the national holiday on Sunday, October 5th in Portugal, the Day of the Establishment of the Republic. In the Spanish market, the increase was 0.8%. In contrast, electricity demand decreased in the markets of Italy, Great Britain, Germany, France, and Belgium. The Italian market registered the largest drop, 2.7%, maintaining its downward trend for the third consecutive week, while the Belgian market registered the smallest decrease, 0.1%. France, Germany, and Belgium reduced their demand by 0.5%, 0.6%, and 2.0%, respectively. In the German market, the national holiday of October 3rd, the Day of German Unity, influenced the decline.

During the week, average temperatures were higher than the previous week in most of the markets analyzed. Increases ranged from 0.9°C in Great Britain to 1.9°C in France. In contrast, Germany and Italy recorded decreases of 1.4°C and 3.2°C, respectively.

For the week of October 6, AleaSoft Energy Forecasting ‘s demand forecasts indicate that demand will decrease in most major European markets. However, demand is expected to increase in Portugal and Germany.

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.European electricity markets

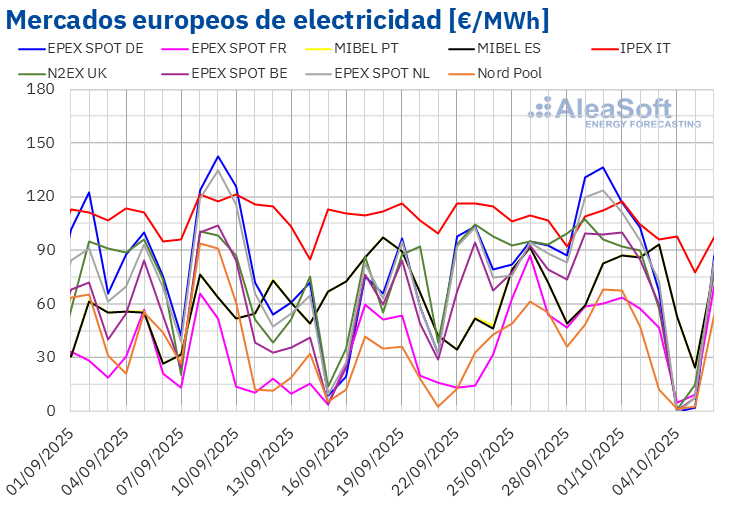

In the first week of October, the average prices of most of the main European electricity markets fell compared to the previous week. The exception was the MIBEL market in Portugal and Spain, with increases of 14% and 15%, respectively. On the other hand, the EPEX SPOT market in France registered the smallest price drop, of 2.8%. In contrast, the N2EX market in the United Kingdom recorded the largest percentage drop in prices, of 32%. In the rest of the markets analyzed by AleaSoft Energy Forecasting , prices fell between 6.1% in the IPEX market in Italy and 18% in the EPEX SPOT market in Belgium.

During the week of September 29, weekly averages were below €70/MWh in most European electricity markets. The exceptions were the Dutch, German, and Italian markets, whose averages were €75.45/MWh, €79.17/MWh, and €101.99/MWh, respectively. The Nord Pool market in the Nordic countries recorded the lowest weekly average, at €35.33/MWh. In the rest of the markets analyzed by AleaSoft Energy Forecasting , prices ranged from €42.94/MWh in the French market to €69.42/MWh in the Portuguese market.

Regarding daily prices, on Saturday, October 4, most markets recorded prices below €5/MWh. In the German and Dutch markets, daily prices were negative. The Dutch market reached the lowest weekly average among the markets analyzed, at €‑1.11/MWh. This was its lowest price since July 7, 2024. In the case of the German market, the price was €‑0.29/MWh, its lowest daily price since December 25, 2023. The British market recorded a higher price, at €0.48/MWh. However, this was its lowest daily price since May 24, 2020.

Meanwhile, during the first week of October, daily prices exceeded €100/MWh in the German, Belgian, British, Italian, and Dutch markets. On September 30, the German market reached its highest daily average of the week, at €136.17/MWh.

During the week of September 29, the decline in weekly gas prices, the increase in wind and solar production, and the decline in demand in most markets led to lower prices in the European electricity markets. However, increased demand in Spain and Portugal, as well as the decline in wind and solar production in the Iberian Peninsula, contributed to the increase in prices in the MIBEL market.

AleaSoft Energy Forecasting ‘s price forecasts indicate that, in the second week of October, prices will rise in most of the main European electricity markets, influenced by the decline in wind energy production. Furthermore, electricity demand will increase in some markets, and solar energy production will decline in the German market.

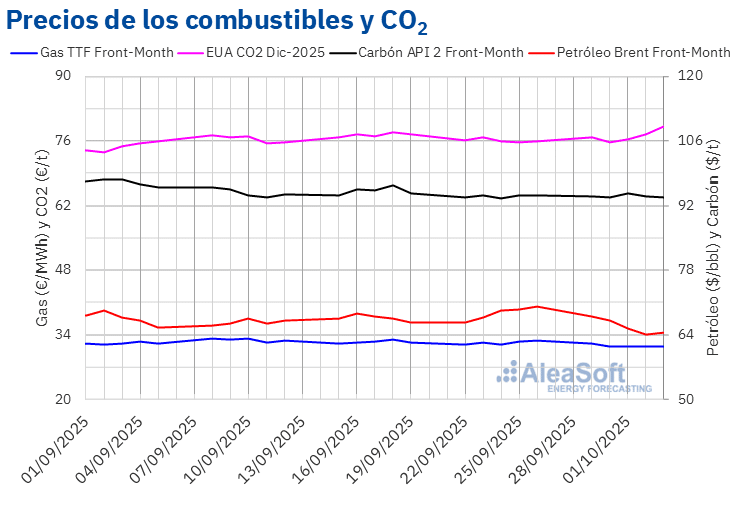

Brent, fuels and CO 2

Brent oil futures for the Front-Month on the ICE market reached their weekly high of $67.97/bbl on Monday, September 29. This price was already 3.1% lower than the previous Friday. The downward trend continued until Thursday, October 2. On that day, these futures registered their weekly low of $64.11/bbl. According to data analyzed by AleaSoft Energy Forecasting , this price was the lowest since May 31. On Friday, October 3, the closing price was slightly higher, at $64.53/bbl, but still 8.0% lower than the previous Friday.

Demand concerns, as well as the resumption of oil exports from Kurdistan, exerted a downward influence on Brent crude oil futures prices in the first week of October. Expectations of further production increases by OPEC+ also led to lower prices during the week. On Sunday, October 5, the organization agreed to increase its production by 137,000 barrels per day in November.

Regarding TTF gas futures on the ICE Front-Month market, on Monday, September 29, they reached their weekly maximum settlement price of €32.06/MWh. During the remaining sessions of the first week of October, prices remained below €32/MWh. On October 1, these futures registered their weekly minimum settlement price of €31.34/MWh. On Friday, October 3, the settlement price was €31.44/MWh. According to data analyzed by AleaSoft Energy Forecasting , this price was 3.9% lower than that of the previous Friday.

Abundant supplies of liquefied natural gas and European reserve levels, which averaged over 82%, kept TTF gas futures prices below €32/MWh for most of the first week of October.

Regarding CO2 emission rights futures on the EEX market for the December 2025 reference contract, prices rose in most sessions during the first week of October, except for Tuesday, September 30. On that day, after a 1.4% drop compared to Monday, these futures registered their weekly minimum settlement price of €75.74/t. Subsequently, prices continued to rise. As a result, on Friday, October 3, these futures reached their weekly maximum settlement price of €79.14/t. According to data analyzed by AleaSoft Energy Forecasting , this price was 4.2% higher than the previous Friday and the highest since February 15.