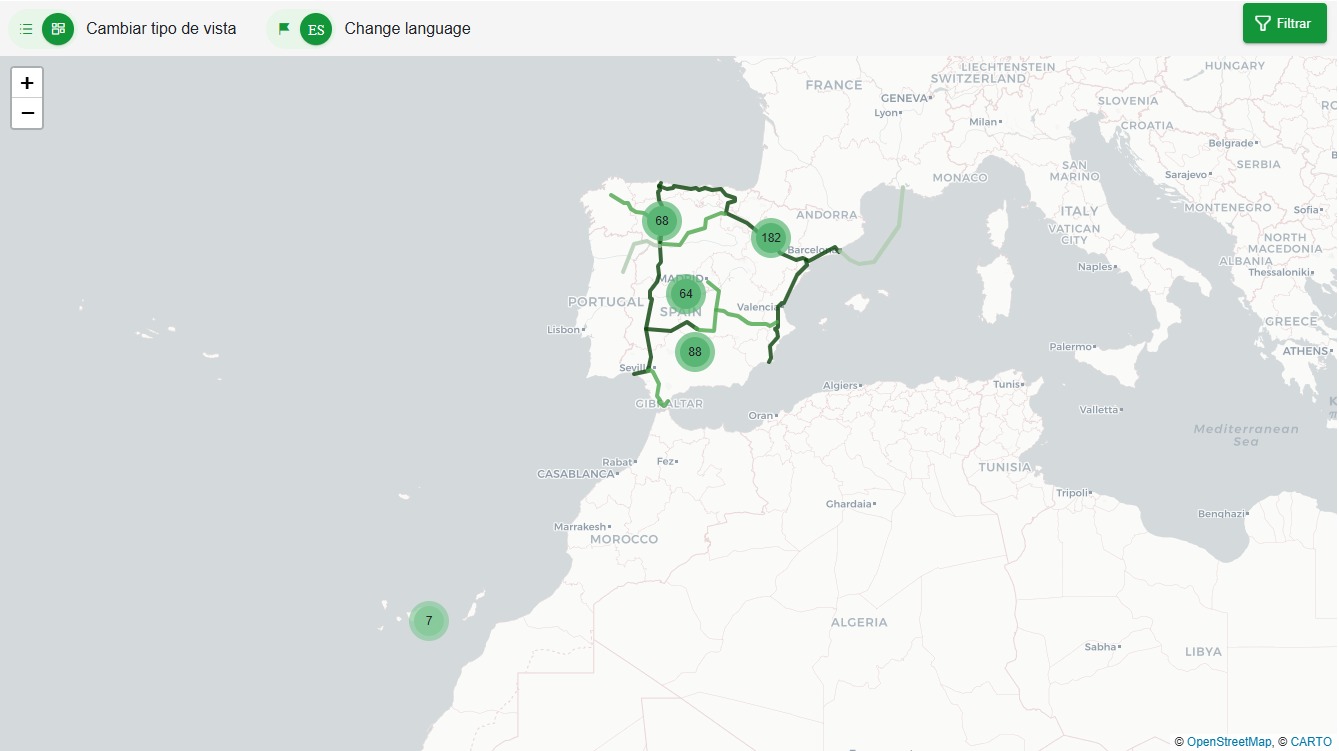

The Spanish Hydrogen Association (AeH2) today presented the updated AeH2 Projects Census 2025, which currently includes a total of 399 projects driven by members of the Association across the entire hydrogen value chain.

This new edition consolidates the Census as a benchmark tool to understand the real development and maturity of the hydrogen sector in Spain. Furthermore, this year’s edition incorporates for the first time information on the renewable energies associated with the projects, the possibility of viewing data in English, the estimation of direct and indirect jobs over various time horizons, as well as other updated indicators reflecting the sector’s evolution over the past year.

The total portfolio of registered projects amounts to an investment of over €33 billion, of which approximately €2.8 billion comes from public funding. This figure reflects the joint commitment of both the public and private sectors to the deployment of renewable hydrogen in Spain, as well as the increasing maturity of a project portfolio that once again spans from research to commercial initiatives.

In total, the AeH2 Projects Census 2025 includes 124 research projects (TRL 3–4), 125 demonstration projects (TRL 5–8), and 145 commercial projects.

According to the data collected, the estimated installed electrolysis capacity by 2030 stands at 13.3 GW, exceeding the target set in Spain’s National Integrated Energy and Climate Plan (PNIEC) of 12 GW, and aligning with the 2026–2030 Electricity Planning Proposal.

If all 145 commercial projects are executed, total capacity could reach 20 GW, with an estimated annual hydrogen production of 2.65 million tonnes. However, a significant portion of this portfolio remains in preliminary development phases, and not all projects have a defined commissioning date; therefore, the realisation of this additional capacity by 2030 cannot be guaranteed. Execution will depend on progress towards the Final Investment Decision (FID) and subsequent construction timelines.

Javier Brey, President of the Spanish Hydrogen Association (AeH2), highlighted: “The AeH2 Projects Census 2025 provides an accurate snapshot of a sector that has achieved remarkable maturity over the past year. This evolution enables greater certainty regarding project potential and strengthens the Census as a reference tool for companies, technology centres, research institutions and public administrations.”

However, he also noted that: “We continue to face barriers that slow down the pace required to realise the potential of renewable hydrogen in Spain, especially in terms of regulation, grid access and demand creation. From AeH2, we will continue to work to overcome these challenges, reinforcing public–private collaboration and consolidating the conditions necessary for projects to materialise and contribute to national targets and the progress towards a decarbonised economy.”

Grid Access Becomes the Sector’s Main Barrier, Alongside Lack of Demand and Public Funding

The AeH2 Projects Census 2025 also identifies the main challenges facing commercial hydrogen projects in Spain. This year, grid access has risen from fourth to first place among the sector’s concerns, due to grid connection point congestion, associated costs, and the need for more long-term planning.

Demand from offtakers continues to be a decisive factor for ensuring the economic viability of projects, highlighting the importance of promoting support mechanisms such as Contracts for Difference (CfDs) and collaborative frameworks to foster stable markets for renewable hydrogen.

The regulatory framework continues to evolve, with the transposition of the RED III (Renewable Energy Directive) and the Gas and Hydrogen Package still under development, as well as the need to define clear criteria for grid access and renewable hydrogen certification. In parallel, access to public financing remains key to support project execution, with various initiatives and programmes seeking to facilitate participation and ensure the viability of developments.

Overcoming these challenges will enable projects to be realised and contribute to meeting national and European goals, advancing towards a decarbonised economy. AeH2 continues to collaborate with public administrations, companies, and research centres to promote solutions that consolidate Spain’s position as a reference country in the hydrogen economy.

Thanks to the commitment of its members and the sector’s dynamism, the AeH2 Projects Census 2025 remains a key tool for assessing progress and guiding strategies that drive renewable hydrogen development in Spain.

The interactive map and the updated analysis of the AeH2 Projects Census 2025 are available on the AeH2 website.