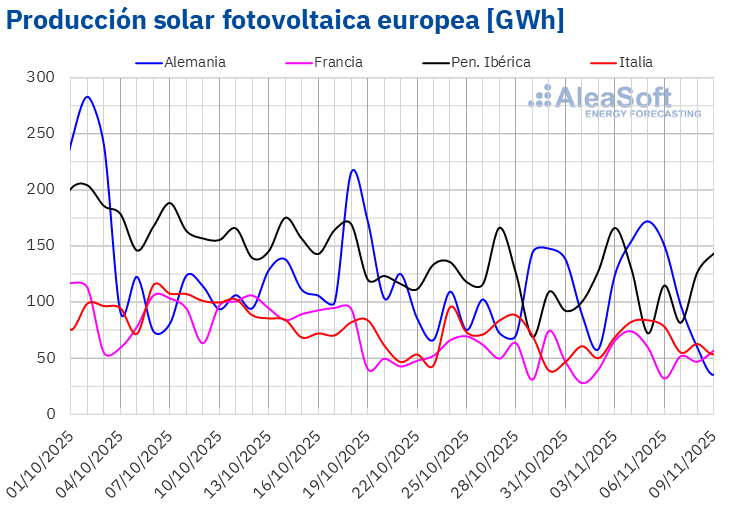

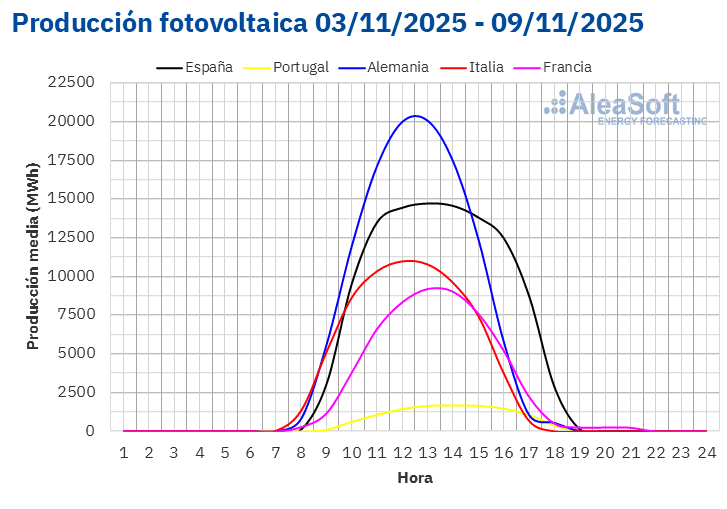

In the first week of November, solar photovoltaic production increased in the main European markets compared to the previous week. The French market registered the largest increase, at 16%, while the Spanish market showed the smallest, at 4.9%. The German, Italian, and Portuguese markets saw increases of 10%, 11%, and 13%, respectively. Germany recorded its second consecutive week of growth in generation with this technology, while the other markets reversed course after registering declines for several consecutive weeks.

During the week, major European markets set all-time records for solar photovoltaic production for a single day in November. Spain and Portugal reached their peak photovoltaic generation for November on the 3rd, with 149 GWh and 17 GWh, respectively. On Tuesday, November 4th, the French market reached its record, with 74 GWh. The German and Italian markets broke their November records on the 5th, with 172 GWh in Germany and 83 GWh in Italy.

According to AleaSoft Energy Forecasting ‘s solar production forecasts , photovoltaic production will increase in the Spanish market during the second week of November , but is expected to decrease in the Italian and German markets.

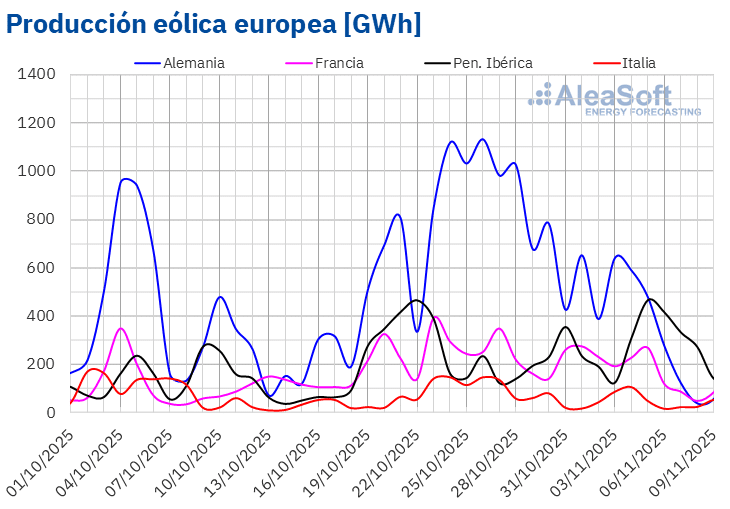

During the first week of November, wind power production increased in the Iberian Peninsula markets compared to the previous week, reversing the downward trend of the preceding seven days. The Spanish market registered the largest increase, at 42%, while the Portuguese market saw a 35% rise. In contrast, the Italian, French, and German markets continued their declines for the second consecutive week, with drops of 14%, 37%, and 55%, respectively.

In the week of November 10, according to AleaSoft Energy Forecasting ‘s wind power production forecasts , wind power generation will increase in the French, German and Spanish markets, while it will decrease in the Italian and Portuguese markets.

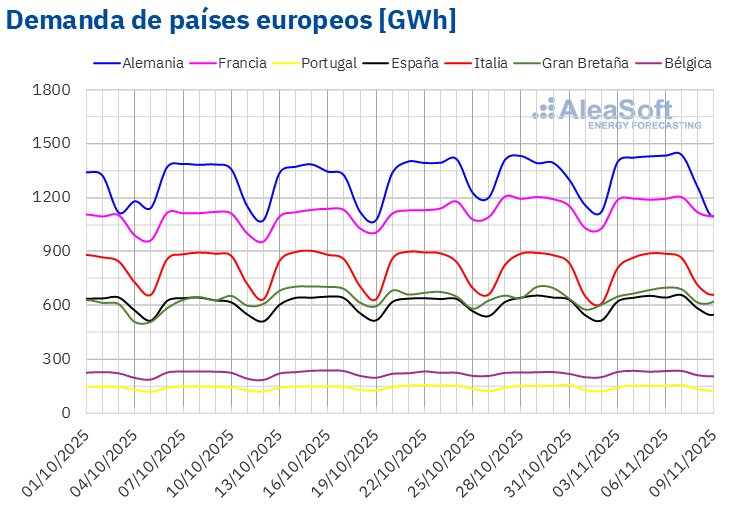

Electricity demand

In the first week of November, electricity demand increased in major European markets compared to the previous week. The Belgian market saw the largest increase, at 3.7%, while the Portuguese market registered the smallest rise, at 1.4%. In the Italian, French, Spanish, British, and German markets, demand increases ranged from 1.9% in Italy to 2.9% in Germany. The French market recorded increases for the fifth consecutive week. The increased demand in most markets was driven by cooler temperatures and the return to work after the All Saints’ Day holiday on November 1st, which was observed in Belgium, Spain, Portugal, Italy, and France.

During the week, average temperatures fell in most of the markets analyzed compared to the previous week. Italy recorded the largest decrease, of 2.8°C, while France experienced the smallest drop, of 1.1°C. Belgium and Great Britain were the exceptions, with average temperature increases of 1.4°C and 2.1°C, respectively.

For the week of November 10, according to AleaSoft Energy Forecasting ‘s demand forecasts , demand will decrease in the French, Belgian, Portuguese, and German markets. Conversely, it is expected to increase in Great Britain, Italy, and Spain.

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.European electricity markets

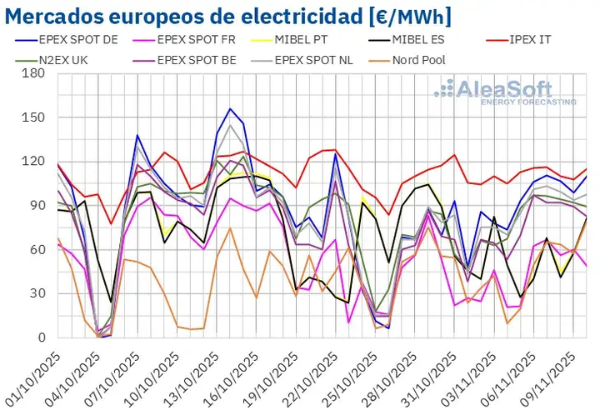

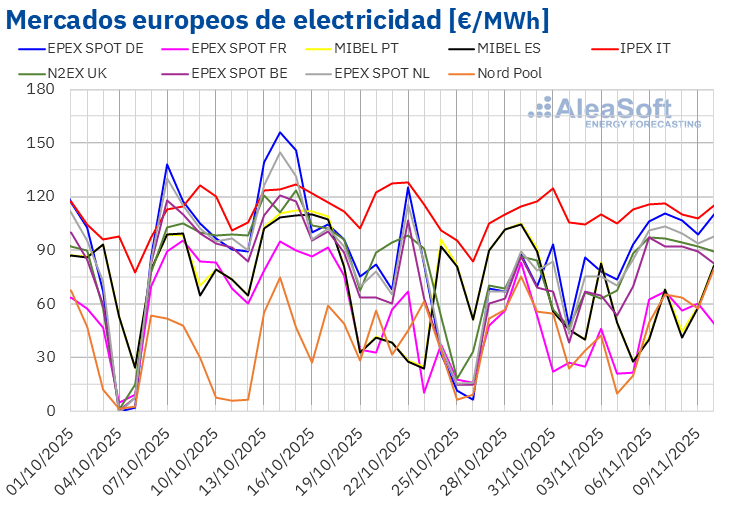

In the first week of November, average prices in most major European electricity markets rose compared to the previous week. However, the Nord Pool market in the Nordic countries and the MIBEL market in Portugal and Spain saw declines of 13%, 29%, and 30%, respectively. The IPEX market in Italy also experienced a slight decrease of 0.5%. In the remaining markets analyzed by AleaSoft Energy Forecasting , prices rose between 6.0% in the EPEX SPOT market in France and 29% in the EPEX SPOT market in Germany.

During the week of November 3, weekly averages exceeded €75/MWh in most European electricity markets. The exceptions were the Nordic, French, Spanish, and Portuguese markets, with averages of €43.91/MWh, €47.71/MWh, €52.50/MWh, and €53.21/MWh, respectively. The Italian market reached the highest weekly average at €110.99/MWh. In the remaining markets analyzed by AleaSoft Energy Forecasting , prices ranged from €79.81/MWh in the Belgian market to €95.39/MWh in the German market.

Regarding daily prices, the Nordic market reached the lowest average price of the week among the analyzed markets, at €9.81/MWh, on November 4. However, during the first week of November, daily prices remained above €100/MWh in the Italian market. The Dutch market also recorded prices above €100/MWh on November 6 and 7, while the German market recorded them on November 6, 7, and 8. On Friday, November 7, the Italian market reached the highest daily average price of the week, at €116.29/MWh.

During the week of November 3, increased demand, higher weekly prices for CO2 emission allowances , and a drop in wind power generation led to higher prices in most European electricity markets. However, a significant increase in wind power generation on the Iberian Peninsula, along with increased solar power production, contributed to lower prices in the MIBEL market.

AleaSoft Energy Forecasting ‘s price forecasts indicate that, in the second week of November, prices could fall in markets such as Belgium and France, influenced by a drop in electricity demand. Conversely, electricity demand will increase, contributing to higher prices, in markets such as the Netherlands and the UK’s N2EX market .

Brent crude, fuels and CO2

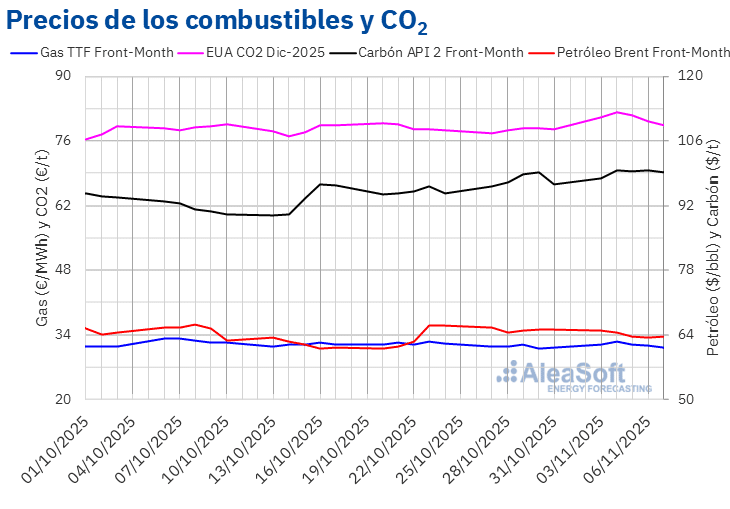

Brent crude oil futures for Front-Month delivery on the ICE market reached their weekly high closing price of $64.89/bbl on Monday, November 3. This price was already 0.3% lower than the closing price of the previous week. The downward trend continued until Thursday, November 6. On that day, these futures recorded their weekly low closing price of $63.38/bbl. On Friday, November 7, the closing price was slightly higher at $63.63/bbl. According to data analyzed by AleaSoft Energy Forecasting , this price was 2.2% lower than the previous Friday.

In the first week of November, the agreements reached by OPEC+ on Sunday, November 2, exerted downward pressure on Brent crude oil futures prices. OPEC+ will increase its production in December, while agreeing to halt production increases during the first quarter of 2026. Furthermore, US oil inventories increased, also contributing to the price decline.

As for TTF gas futures on the ICE market for Front-Month, they reached their weekly high closing price of €32.55/MWh on Tuesday, November 4. Prices subsequently declined. Consequently, on Friday, November 7, these futures recorded their weekly low closing price of €31.20/MWh. According to data analyzed by AleaSoft Energy Forecasting , this price was still 0.3% higher than the previous Friday.

The abundant supply of liquefied natural gas helped keep TTF gas futures prices below €32/MWh for almost the entire first week of November.

Regarding CO2 emission allowance futures on the EEX market for the benchmark December 2025 contract, closing prices exceeded €80/t for almost the entire first week of November, except for Friday. On Tuesday, November 4, these futures reached their weekly high closing price of €82.31/t. According to data analyzed by AleaSoft Energy Forecasting , this price was the highest since February 12. Conversely, on Friday, November 7, these futures registered their weekly low closing price of €79.49/t. This price was still 1.2% higher than the previous Friday’s closing price.

AleaSoft Energy Forecasting analysis on the outlook for energy markets in Europe and energy storage

On Thursday, November 13, AleaSoft Energy Forecasting will hold its next webinar. This will be the 60th edition of its monthly webinar series . In addition to the evolution and outlook for European energy markets for winter 2025-2026, the webinar will address the outlook for batteries , hybridization , and energy storage , as well as AleaSoft’s services for battery and hybridization projects. The guest speaker will be Luis Marquina de Soto, president of AEPIBAL , the Spanish Association of Batteries and Energy Storage Companies.