During the week of September 8, solar photovoltaic production increased in the Iberian Peninsula markets compared to the previous week. The Portuguese market registered the largest increase, 13%, after two weeks of declines. The Spanish market posted a 2.3% increase, maintaining its upward trend for the second consecutive week. During the week, both Spain and Portugal reached historic highs in solar photovoltaic generation for a September day. In Portugal, the record was reached on Tuesday the 9th, with 25 GWh, while in Spain it was reached on Friday the 12th, with 193 GWh.

However, in the French, German, and Italian markets, solar PV generation decreased compared to the first week of September. France recorded the smallest drop, 18%, while Italy and Germany each saw their production decrease by 19%. Germany recorded four consecutive weeks of declines.

For the week of September 15, AleaSoft Energy Forecasting ‘s solar production forecasts anticipate increases in solar photovoltaic production in the German, Italian, and Spanish markets.

In the second week of September, wind power production increased in most major European markets compared to the previous week. Portugal recorded the largest increase, 14%, while Italy saw the smallest increase, 4.7%. Germany maintained its upward trend for the second consecutive week, increasing its production by 12%. In contrast, wind power generation declined in the French and Spanish markets, breaking the streak of increases seen in the previous two weeks in France and the previous three in Spain. France recorded the smallest decline, 11%, while Spain saw its production decrease by 25%.

For the third week of September, AleaSoft Energy Forecasting ‘s wind energy production forecasts predict an increase in the German market and declines in the French, Italian, Spanish, and Portuguese markets.

Electrical demand

In the second week of September, electricity demand increased in most major European markets compared to the previous week. The Italian market recorded the largest increase, 4.1%, marking four consecutive weeks of growth. In the German, French, and Portuguese markets, demand increased by 0.2%, 0.3%, and 0.8%, respectively. Germany and Portugal continued the upward trend for a third consecutive week.

In contrast, demand in the Spanish, British, and Belgian markets decreased compared to the first week of September. The Spanish market recorded the smallest drop, 0.4%, maintaining its downward trend for the second consecutive week. In the British market, demand decreased by 1.1%. Belgium saw the largest decline, 1.4%, after six weeks of increases.

Average temperatures were below the previous week’s average in most of the markets analyzed. Great Britain recorded the largest drop, 2.4°C, while the Iberian Peninsula saw the most moderate decreases, 0.1°C in Portugal and 0.4°C in Spain. France, Belgium, and Germany recorded drops of 1.3°C, 1.6°C, and 1.7°C, respectively. Italy maintained average temperatures similar to the previous week.

For the week of September 15, AleaSoft Energy Forecasting ‘s demand forecasts anticipate increases in demand in the British, Spanish, and French markets, while the Italian, Portuguese, German, and Belgian markets will register declines.

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.European electricity markets

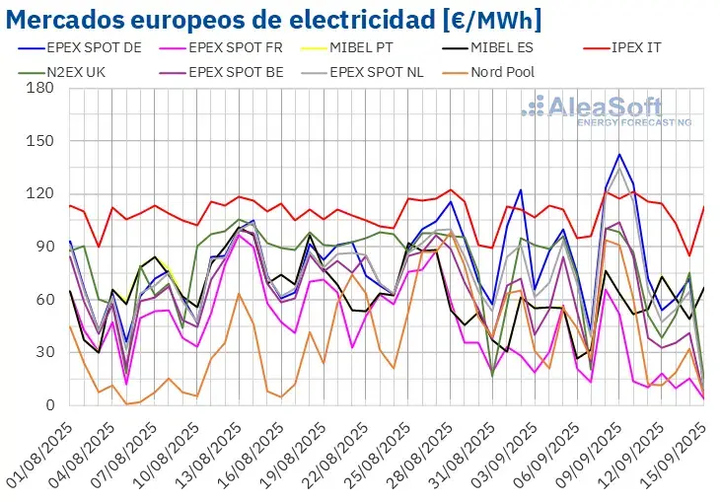

In the second week of September, the average prices of most major European electricity markets increased compared to the previous week. The exceptions were the N2EX market in the United Kingdom and the EPEX SPOT market in France, whose averages fell by 3.8% and 8.5%, respectively. The IPEX market in Italy and the Nord Pool market in the Nordic countries registered the lowest price increases, 4.4% in both cases. In contrast, the MIBEL market in Portugal and Spain achieved the highest percentage price increases, 35% and 36%, respectively. In the rest of the markets analyzed by AleaSoft Energy Forecasting , prices rose between 9.5% in the EPEX SPOT market in Germany and 19% in the EPEX SPOT market in the Netherlands.

During the week of September 8, weekly averages remained below €75/MWh in most European electricity markets, despite price increases. The exceptions were the Dutch, German, and Italian markets, whose averages were €85.92/MWh, €92.99/MWh, and €111.16/MWh, respectively. The French market recorded the lowest weekly average, at €26.36/MWh. In the rest of the markets analyzed by AleaSoft Energy Forecasting , prices ranged from €45.55/MWh in the Nordic market to €71.64/MWh in the British market.

Regarding daily prices, on Saturday, September 13, the French market reached its lowest average for the second week of September among the markets analyzed, at €9.69/MWh. At the beginning of the third week of September, on Monday, September 15, most European electricity markets recorded daily prices below €15/MWh. The French market again recorded the lowest price, at €3.38/MWh. This price was the lowest in the French market since June 9. The Belgian, British, and Dutch markets reached their lowest prices since May on September 15, while the German market recorded its lowest price since January 2.

Meanwhile, in the second week of September, the German, Belgian, British, Italian, and Dutch markets recorded daily prices above €100/MWh. On September 9, the German market reached its highest daily average of the week, €142.45/MWh. This was its highest price since February 18. Furthermore, on September 8, between 7:00 p.m. and 8:00 p.m., the German market recorded a price of €413.66/MWh, the highest hourly price since July 1.

During the week of September 8, rising weekly gas and CO2 emission allowance prices , a decline in solar energy production, and increased demand in most markets fueled price increases in European electricity markets. The decline in wind energy production in the Iberian Peninsula also contributed to the rise in prices on the MIBEL market.

AleaSoft Energy Forecasting ‘s price forecasts indicate that, in the third week of September, prices will fall in most European electricity markets, influenced by the increase in solar energy production and the decline in demand in some markets. Furthermore, wind energy production will increase significantly in Germany.

Brent, fuels and CO 2

Brent oil futures for the Front-Month on the ICE market registered their weekly minimum settlement price of $66.02/bbl on Monday, September 8. This value exceeded that of the previous Friday and initiated a series of increases in the following sessions. As a result, on September 10, these futures reached their weekly maximum settlement price of $67.49/bbl. In the final sessions of the second week of September, prices remained below $67/bbl. On Friday, September 12, the settlement price was $66.99/bbl. According to data analyzed by AleaSoft Energy Forecasting , this price was 2.3% higher than that of the previous Friday.

Rising geopolitical tensions exerted an upward influence on Brent oil futures prices in the second week of September. However, concerns about demand trends and planned production increases by OPEC+ limited the gains.

Regarding TTF gas futures on the ICE market for the Front-Month, on Monday, September 8, the settlement price was €33.06/MWh, 3.4% higher than the last session of the previous week. On September 10, these futures reached their weekly maximum settlement price of €33.12/MWh. However, on Thursday, September 11, after a 2.4% drop compared to the previous day, they registered their weekly minimum settlement price of €32.32/MWh. On Friday, September 12, the settlement price was €32.66/MWh. According to data analyzed by AleaSoft Energy Forecasting , this price was 2.2% higher than that of the previous Friday.

In the second week of September, TTF gas futures prices remained above €32/MWh, influenced by rising tensions in the Middle East and between Russia and Ukraine. However, European stockpile levels near 80% and the completion of maintenance work in Norway helped prevent prices from reaching €34/MWh.

Regarding CO2 emission rights futures on the EEX market for the December 2025 reference contract, settlement prices remained above €75/t during the second week of September. On Monday, September 8, they reached their weekly maximum settlement price of €77.16/t. According to the data analyzed by AleaSoft Energy Forecasting , this price was the highest since February 18. In contrast, on Thursday, September 11, these futures registered their weekly minimum settlement price of €75.55/t. On Friday, September 12, the price was slightly higher, at €75.78/t. This price was 0.3% lower than that of the previous Friday.