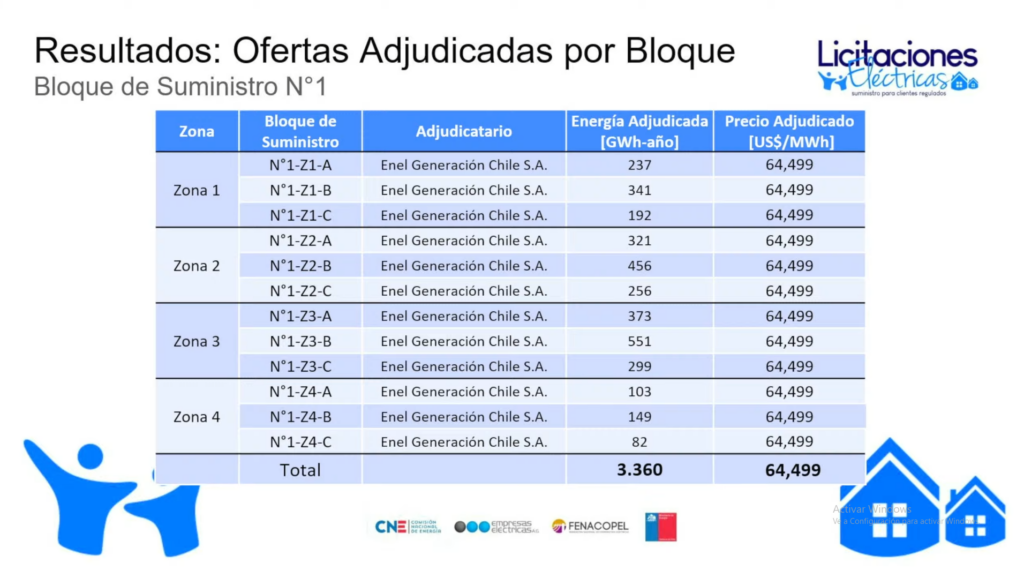

Enel Generación Chile once again emerged as the clear winner of Chile’s regulated power supply auction, securing 100% of the volume awarded in the 2025/01 tender. The company will supply 3.36 TWh of electricity between 2027 and 2030 to regulated customers at an average price of USD 64.5 per MWh, according to official results.

This outcome marks the second consecutive Chilean supply auction fully awarded to a single company, reinforcing Enel’s dominant position in the country’s power generation and retail supply market.

The tender was structured around **four geographic zones—north, central, central-south and south—**each divided into three time-of-use blocks: peak, off-peak (valley) and night. In total, 12 sub-blocks were offered. Enel submitted bids for all of them and succeeded in winning every single block.

According to market records, the company presented 384 economic bids, replicating its strategy of full and simultaneous coverage across all possible combinations of zones and time bands. This aggressive bidding approach left no room for partial awards to competing generators.

The 2025/01 auction was held under particularly complex conditions, shaped by Chile’s ongoing electoral process—with a presidential runoff scheduled for the following weekend—along with high levels of renewable energy curtailment, uncertainty around future power prices, and an evolving regulatory framework that continues to raise questions among market participants.

Only six generation companies took part in the process: Colbún, Guacolda, BTG Pactual, Enel Generación Chile, Evol Energy and Grenergy. This limited participation made the 2025/01 tender the second least competitive auction in terms of number of bidders over the past decade, highlighting growing concerns about market concentration.

Comparison with previous auctions

With this result, Enel repeated the strategy that allowed it to capture 100% of the 2023/01 supply auction, when it was awarded 1.5 TWh in Block No. 1 and 2.1 TWh in Block No. 2 across all zonal systems and time blocks, at an average price of USD 56.7/MWh.

At that time, Enel stood out as the company with the largest project portfolio submitted, including 15 renewable energy projects totaling 2.8 GW of installed capacity and five gas-fired thermal power plants adding nearly 2.0 GW. This portfolio enabled the company to submit 216 economic bids—108 for each supply block—competing across every segment of the auction.

In nominal terms, the awarded price in the 2025/01 auction represents a 13.8% increase compared to 2023, reflecting shifts in Chile’s power market dynamics. More broadly, the outcome confirms a trend observed in the last two auction processes: rising average prices and increasing concentration of awarded volumes.

From a market structure perspective, the last two tenders stand out as an exception to historical patterns, in which supply blocks were typically distributed among a more diverse group of generators.

Overall, the results of Chile’s 2025/01 power supply auction send a clear signal to policymakers and industry stakeholders. While Enel has once again demonstrated its competitive strength, the process has reignited debate over the need for regulatory adjustments aimed at encouraging greater participation, preserving competitive balance, ensuring long-term supply reliability, maintaining reasonable prices for regulated customers, and supporting continued investment in renewable energy and new generation technologies.