The AEGE Energy Barometer for September 2025 reveals that domestic electro-intensive consumers pay 2.5 times more than in France and 34% more than in Germany, widening the competitive gap in the industrial sector.

The AEGE Energy Barometer for September 2025 reveals that domestic electro-intensive consumers pay 2.5 times more than in France and 34% more than in Germany, widening the competitive gap in the industrial sector.

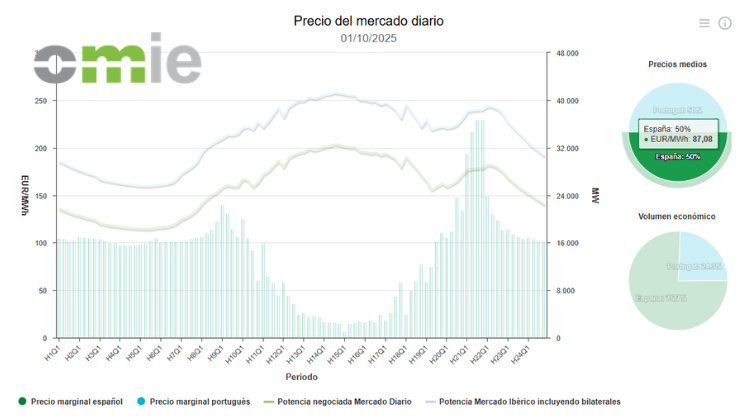

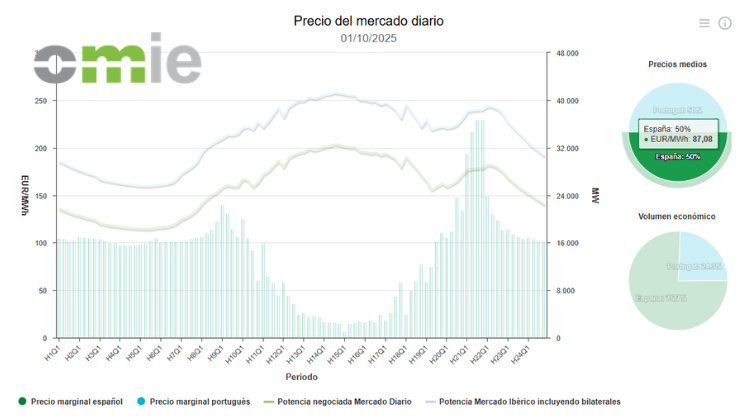

Industry representatives stress that the change sharpens price signals, reduces deviations, demands greater forecasting accuracy and, at the same time, opens up new opportunities for profitability, flexibility, storage and demand management.

The study will develop surveys and debates on aspects related to the energy transition, such as renewable deployment, electric mobility or self-consumption, among other issues. Its results will guide the design of new public policies to drive this transformation and take advantage of the economic and industrial benefits associated with the country’s renewable potential. It will have a total budget of 355,000 euros, of which 70% will be covered by the Institute, while the CIS will assume the remainder.

MITECO is evaluating measures to ensure the development of green gas. Representatives of Autonomous Communities are committed to simplifying the procedures for ongoing projects. This is an energy that can cover 100% of the thermal demand of Spanish homes before 2040.

El MITECO evalúa medidas para asegurar el desarrollo del gas verde. Representantes de Comunidades Autónomas apuestan por simplificar las tramitaciones de los proyectos en curso. Se trata de una energía que puede cubrir el 100% de la demanda térmica de los hogares españoles antes de 2040.

The Ministry aims to publish the draft in October. The regions broadly support the approach but call for more capacity for industry and hydrogen, denser territorial coverage and stronger security of supply; some also seek additional investment and greater agility.

Spain has more than 28 GW of offshore wind capacity in environmental processing, awaiting the ministerial order that will define the rules and calendar for auctions. Industry giants such as Repsol, Iberdrola, BlueFloat, Cobra and Capital Energy lead the way.

Castilla-La Mancha generates more than 25% of all its electricity from solar photovoltaic energy and is one of the regions with the greatest room for growth in biomass and energy storage. “The energy transition is not only an environmental opportunity, but also a lever for development and territorial cohesion,” stressed Marina Serrano, president of aelēc, during the conference “Rural Environment: Energy Transition and Economic Integration” held in Toledo.

With more than 1.1 GW installed in Spain and 120 MW in Italy, Negratín Global Services projects 2–3 years of contractual visibility and is preparing its expansion as an IPP, with a strong focus on hybrid projects with batteries.

The group will invest €58 billion through to 2028, focusing on the UK and the US, and aims to increase its regulated asset base to €70 billion, while surpassing 60 GW of installed renewable capacity.

The financing will support projects to improve the energy efficiency of production processes and to develop renewable energy self-generation at industrial plants in Italy and, to a lesser extent, in the Czech Republic. The transaction will enhance the competitiveness of the Italian packaging multinational and accelerate its transition toward a low-carbon production model.

These initiatives will strengthen regional energy cooperation, accelerate the deployment of clean technologies, and support the EU’s 2030 climate and energy targets.

The director of e-Anell, Ramón Gallart Fernández, asserts that flexible connections represent a key opportunity to make use of unused grid capacity and attract new investment.

This is the company’s sixth green bond issue, which has been closed for a six-year term and a yield of 3.018%. The company is immersed in boosting its investments in electricity grids to meet new demands and continue consolidating the ecological transition in Spain. With this new issue, the corporation is moving closer to achieving its goal of securing all of its financing under sustainable criteria by 2030, a percentage that currently stands at around 70%.

Renewable energy sources grew the most: 6.2% in the primary energy matrix and 11.9% in electricity. MITECO’s official energy statistics include the country’s self-consumption capacity for the first time, which reached 8,256 MW by the end of 2024. The weight of natural gas and coal in the national energy mix has decreased, and for the third consecutive year there is an export-oriented electricity balance.

The possibility that RFNBOs used in industry could count towards transport targets breaches the Renewable Energy Directive. Allowing full avoidance of the 2030 advanced biofuels target contradicts the Directive’s recommendation. The transfer of renewable fuel certificates between transport sub-sectors should be removed or capped at 20%.

The Galician Minister for Economy and Industry warned that the sector’s paralysis discourages investment and risks Galicia missing the opportunity to attract offshore wind projects and complete the industrial value chain.

Minister Sara Aagesen defended in Parliament the electricity transmission plan with €13.59 billion, an attractive remuneration framework and measures to optimise the grid, amid rapid growth in renewables and electrification.

El informe, presentado por Deloitte durante el desayuno informativo ‘Conectando el futuro: redes eléctricas para una España más competitiva’, advierte de un marco retributivo poco atractivo para la inversión y apunta varias claves para aprovechar la oportunidad de país. Hasta el momento, España cuenta con la menor Tasa de Retribución Financiera de las inversiones en redes de distribución en Europa (5,58%).

The report, presented by Deloitte during the information breakfast “Connecting the Future: Electricity Grids for a More Competitive Spain,” warns of an unattractive remuneration framework for investment and suggests several key factors for taking advantage of the country’s opportunity. To date, Spain has the lowest Financial Return on Investment in Distribution Networks in Europe (5.58%).

The confirmation of constraints in the distribution grids is challenging the bankability of stand-alone projects, which must now wait for the CNMC to finalise the resolution on flexible demand and capitalise on the drop in CAPEX.

The AEGE Energy Barometer for September 2025 reveals that domestic electro-intensive consumers pay 2.5 times more than in France and 34% more than in Germany, widening the competitive gap in the industrial sector.

Industry representatives stress that the change sharpens price signals, reduces deviations, demands greater forecasting accuracy and, at the same time, opens up new opportunities for profitability, flexibility, storage and demand management.

The study will develop surveys and debates on aspects related to the energy transition, such as renewable deployment, electric mobility or self-consumption, among other issues. Its results will guide the design of new public policies to drive this transformation and take advantage of the economic and industrial benefits associated with the country’s renewable potential. It will have a total budget of 355,000 euros, of which 70% will be covered by the Institute, while the CIS will assume the remainder.

MITECO is evaluating measures to ensure the development of green gas. Representatives of Autonomous Communities are committed to simplifying the procedures for ongoing projects. This is an energy that can cover 100% of the thermal demand of Spanish homes before 2040.

El MITECO evalúa medidas para asegurar el desarrollo del gas verde. Representantes de Comunidades Autónomas apuestan por simplificar las tramitaciones de los proyectos en curso. Se trata de una energía que puede cubrir el 100% de la demanda térmica de los hogares españoles antes de 2040.

The Ministry aims to publish the draft in October. The regions broadly support the approach but call for more capacity for industry and hydrogen, denser territorial coverage and stronger security of supply; some also seek additional investment and greater agility.

Spain has more than 28 GW of offshore wind capacity in environmental processing, awaiting the ministerial order that will define the rules and calendar for auctions. Industry giants such as Repsol, Iberdrola, BlueFloat, Cobra and Capital Energy lead the way.

Castilla-La Mancha generates more than 25% of all its electricity from solar photovoltaic energy and is one of the regions with the greatest room for growth in biomass and energy storage. “The energy transition is not only an environmental opportunity, but also a lever for development and territorial cohesion,” stressed Marina Serrano, president of aelēc, during the conference “Rural Environment: Energy Transition and Economic Integration” held in Toledo.

With more than 1.1 GW installed in Spain and 120 MW in Italy, Negratín Global Services projects 2–3 years of contractual visibility and is preparing its expansion as an IPP, with a strong focus on hybrid projects with batteries.

The group will invest €58 billion through to 2028, focusing on the UK and the US, and aims to increase its regulated asset base to €70 billion, while surpassing 60 GW of installed renewable capacity.

The financing will support projects to improve the energy efficiency of production processes and to develop renewable energy self-generation at industrial plants in Italy and, to a lesser extent, in the Czech Republic. The transaction will enhance the competitiveness of the Italian packaging multinational and accelerate its transition toward a low-carbon production model.

These initiatives will strengthen regional energy cooperation, accelerate the deployment of clean technologies, and support the EU’s 2030 climate and energy targets.

The director of e-Anell, Ramón Gallart Fernández, asserts that flexible connections represent a key opportunity to make use of unused grid capacity and attract new investment.

This is the company’s sixth green bond issue, which has been closed for a six-year term and a yield of 3.018%. The company is immersed in boosting its investments in electricity grids to meet new demands and continue consolidating the ecological transition in Spain. With this new issue, the corporation is moving closer to achieving its goal of securing all of its financing under sustainable criteria by 2030, a percentage that currently stands at around 70%.

Renewable energy sources grew the most: 6.2% in the primary energy matrix and 11.9% in electricity. MITECO’s official energy statistics include the country’s self-consumption capacity for the first time, which reached 8,256 MW by the end of 2024. The weight of natural gas and coal in the national energy mix has decreased, and for the third consecutive year there is an export-oriented electricity balance.

The possibility that RFNBOs used in industry could count towards transport targets breaches the Renewable Energy Directive. Allowing full avoidance of the 2030 advanced biofuels target contradicts the Directive’s recommendation. The transfer of renewable fuel certificates between transport sub-sectors should be removed or capped at 20%.

The Galician Minister for Economy and Industry warned that the sector’s paralysis discourages investment and risks Galicia missing the opportunity to attract offshore wind projects and complete the industrial value chain.

Minister Sara Aagesen defended in Parliament the electricity transmission plan with €13.59 billion, an attractive remuneration framework and measures to optimise the grid, amid rapid growth in renewables and electrification.

El informe, presentado por Deloitte durante el desayuno informativo ‘Conectando el futuro: redes eléctricas para una España más competitiva’, advierte de un marco retributivo poco atractivo para la inversión y apunta varias claves para aprovechar la oportunidad de país. Hasta el momento, España cuenta con la menor Tasa de Retribución Financiera de las inversiones en redes de distribución en Europa (5,58%).

The report, presented by Deloitte during the information breakfast “Connecting the Future: Electricity Grids for a More Competitive Spain,” warns of an unattractive remuneration framework for investment and suggests several key factors for taking advantage of the country’s opportunity. To date, Spain has the lowest Financial Return on Investment in Distribution Networks in Europe (5.58%).

The confirmation of constraints in the distribution grids is challenging the bankability of stand-alone projects, which must now wait for the CNMC to finalise the resolution on flexible demand and capitalise on the drop in CAPEX.

After building a strong distributed generation portfolio across Colombia, Mexico and Central America, the Costa Rican company is pivoting towards utility-scale solar and wind projects, aiming to capitalise on a new wave of multi-gigawatt renewable energy tenders in the region.

Eduardo Oviedo assumes the helm of the Energy Ministry while serving as interim head of the state-owned utility ENEE, at a time when a 1.5 GW power tender is already underway and major sector reforms remain in focus.

The project is progressing on schedule, with 20 wind turbines already installed and commissioning milestones being met.