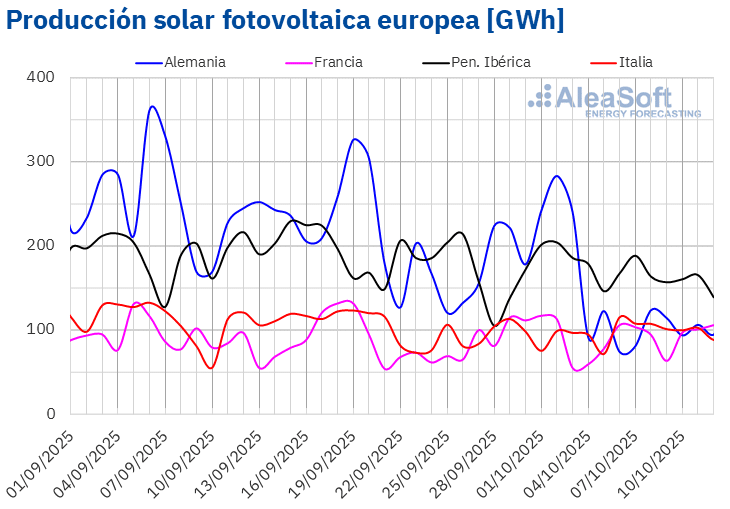

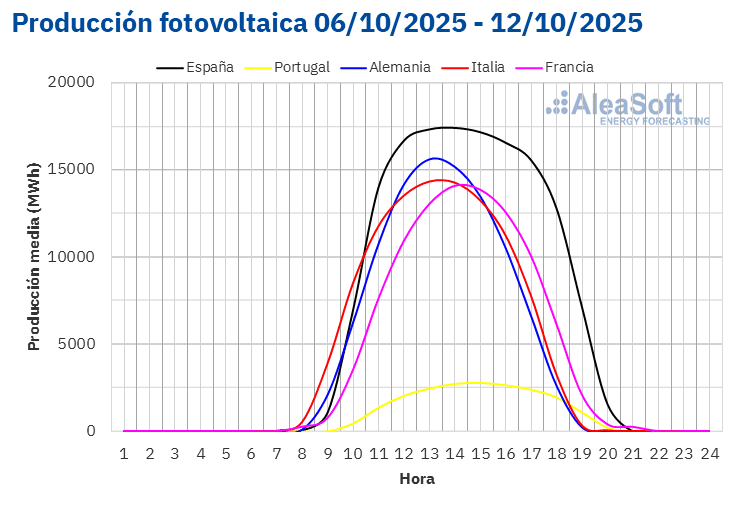

In the second week of October, solar PV production increased in the Italian and French markets compared to the previous week. Italy recorded the largest increase, 11%, while France saw a 3.4% increase. Both markets maintained their upward trend for the second consecutive week. In contrast, the German and Iberian markets recorded declines during the same period. Germany experienced the largest drop, 50%, followed by Portugal, with a fall of 8.5%. Spain recorded the smallest decline, 6.8%, maintaining its downward trend for the third consecutive week.

On Monday, October 6, the Italian market reached its all-time high for photovoltaic production for an October day, with a generation of 115 GWh. On the same day, the Portuguese market achieved its second-highest production ever for an October month, with 23 GWh, following the record set on October 3.

AleaSoft Energy Forecasting ‘s solar production forecasts indicate a recovery in solar energy production during the third week of October in the German market, while the Italian and Spanish markets will register declines in generation with this technology.

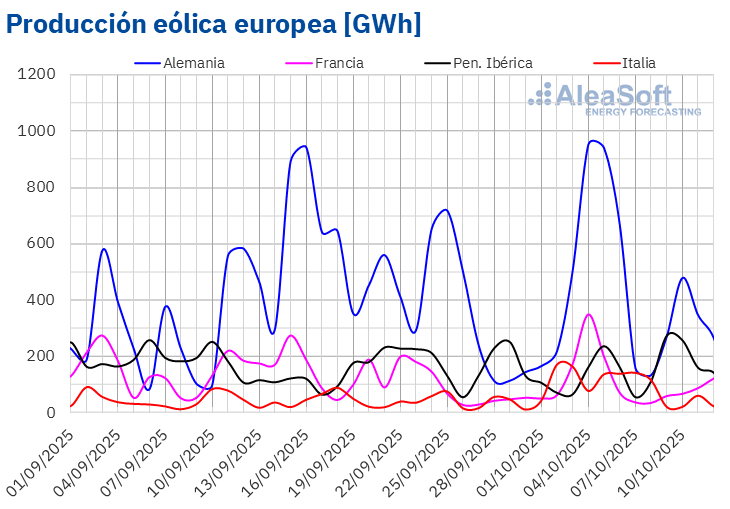

During the week of October 6, wind energy production increased in the Iberian Peninsula markets compared to the previous week. Portugal recorded the largest increase, 16%, while Spain saw a 13% increase. Both markets reversed the downward trend of the previous week. In contrast, the French, German, and Italian markets showed declines in wind generation. France recorded the largest drop, 49%, followed by Germany and Italy, with decreases of 24% and 20%, respectively.

For the week of October 13, AleaSoft Energy Forecasting ‘s wind energy production forecasts anticipate an increase in wind energy production in France, while wind energy generation will decrease in Portugal, Italy, Spain, and Germany.

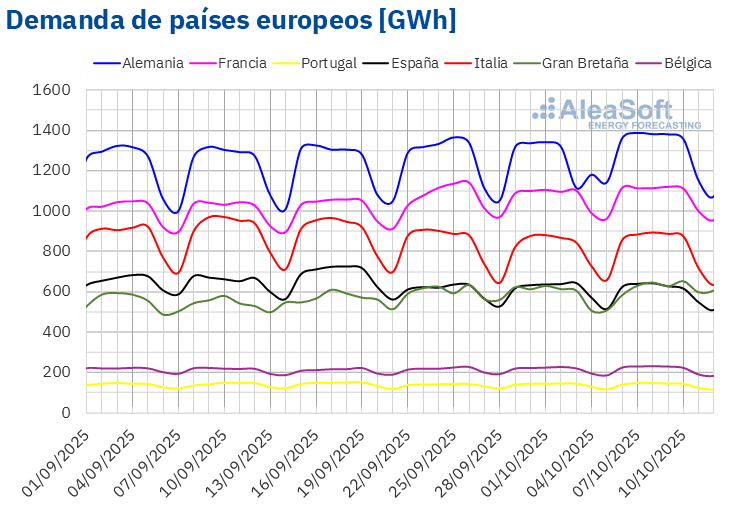

Electrical demand

During the week of October 6, electricity demand increased in most major European markets compared to the previous week. The British market recorded the largest increase, 6.0%, followed by Germany, with a 3.9% increase, driven by the resumption of work activity following the national holiday of October 3, German Unity Day. The Portuguese market showed the smallest increase, 0.1%, while France, Italy, and Belgium recorded increases of 1.1%, 1.2%, and 1.3%, respectively. In contrast, demand in the Spanish market decreased by 1.0%, boosted by the national holiday of October 12, Hispanic Day.

During the week, average temperatures were higher than the previous week in most of the markets analyzed. Increases ranged from 0.2°C in Italy and Great Britain to 2.0°C in Germany. In contrast, France, Portugal, and Spain recorded decreases of 0.2°C, 0.5°C, and 0.8°C, respectively.

For the week of October 13, AleaSoft Energy Forecasting ‘s demand forecasts indicate that demand will increase in Italy and Great Britain, while it will decrease in Germany, France, Spain, Belgium, and Portugal.

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.European electricity markets

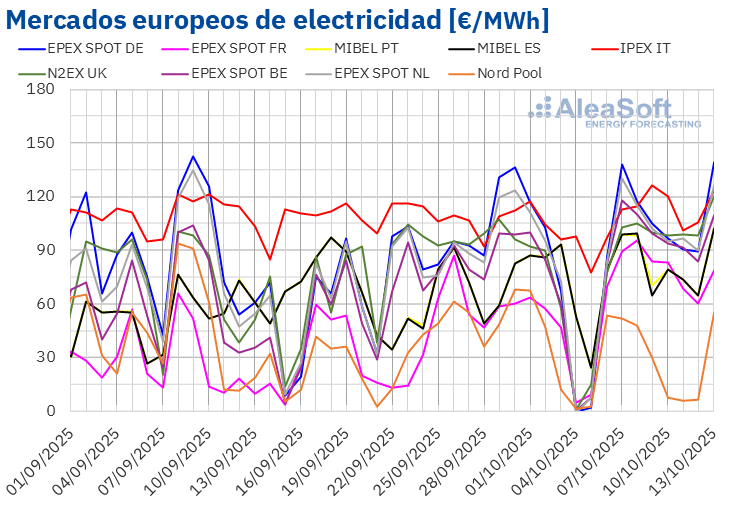

In the second week of October, average prices in most major European electricity markets rose compared to the previous week. The exception was the Nordic countries’ Nord Pool market , with a drop of 18%. Italy’s IPEX market recorded the lowest price increase, at 8.9%. In contrast, France’s EPEX SPOT market saw the highest percentage price increase, at 83%. In the rest of the markets analyzed by AleaSoft Energy Forecasting , prices rose between 15% in Spain’s MIBEL market and 51% in Belgium’s EPEX SPOT market.

During the week of October 6, weekly averages were above €75/MWh in most European electricity markets. The exception was the Nordic market, whose average was €28.85/MWh. The Dutch, German, and Italian markets recorded the highest weekly averages, at €101.74/MWh, €103.27/MWh, and €111.11/MWh, respectively. In the rest of the markets analyzed by AleaSoft Energy Forecasting , prices ranged from €78.47/MWh in the French market to €97.31/MWh in the United Kingdom’s N2EX market .

Regarding daily prices, the Nordic market was the only market whose prices remained below €55/MWh during the second week of October. This market reached the lowest daily average of the week among the markets analyzed, €5.61/MWh, on Saturday, October 11. In contrast, the German, Belgian, British, Italian, and Dutch markets recorded daily prices above €100/MWh. On October 7, the German market reached the highest daily average of the week, €137.96/MWh.

In the week of October 6, rising weekly gas and CO2 emission allowance prices , increased demand, and declining wind and solar production in most markets led to higher prices in European electricity markets. However, increased solar production in Italy, decreased demand in Spain, and increased wind production in the Iberian Peninsula helped limit price increases in the Italian, Spanish, and Portuguese markets.

AleaSoft Energy Forecasting ‘s price forecasts indicate that, in the third week of October, prices will continue to rise in most of the main European electricity markets, influenced by the decline in wind energy production. Furthermore, electricity demand will increase in some markets. However, the decline in demand and the recovery in wind energy production will lead to a drop in prices in the French market.

Brent, fuels and CO 2

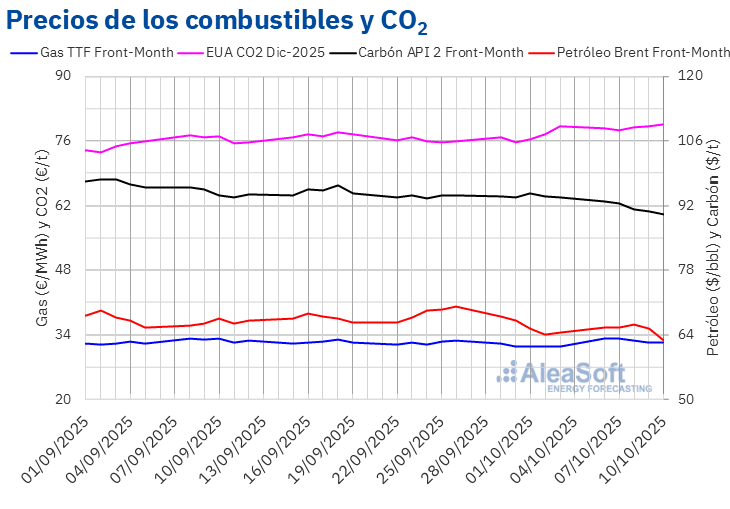

The closing prices of Brent oil futures for the Front-Month on the ICE market remained below $67/bbl in the second week of October. On the 8th, these futures reached their weekly maximum closing price of $66.25/bbl. However, on Friday, October 10, after a 3.8% drop, these futures registered their weekly minimum closing price of $62.73/bbl. According to data analyzed by AleaSoft Energy Forecasting , this price was 2.8% lower than the previous Friday and the lowest since May 8.

The easing of tensions in the Middle East exerted a downward influence on Brent crude oil futures prices. Furthermore, US crude oil stockpiles increased. On Friday, October 10, threats of increased US tariffs on products from China contributed to a drop in these futures prices below $63/bbl. An increase in trade tensions between China and the United States could have negative effects on economic developments and demand.

Regarding the closing prices of TTF gas futures on the ICE market for the Front-Month period, on October 6 and 7, they exceeded €33/MWh. On Tuesday, October 7, they reached their weekly maximum closing price of €33.25/MWh. According to data analyzed by AleaSoft Energy Forecasting , this price was the highest since August 27. However, in the last three sessions of the second week of October, prices fell. On Friday, October 10, these futures registered their weekly minimum closing price of €32.17/MWh. This price was still 2.3% higher than that of the previous Friday.

Despite Russian attacks on Ukrainian gas infrastructure, high European reserve levels contributed to TTF gas futures prices remaining below €33/MWh for most of the second week of October. On average, European reserves exceed 83%, and levels in some countries are above 90%.

Regarding CO2 emission rights futures on the EEX market for the December 2025 reference contract, on Tuesday, October 7, they registered their minimum weekly settlement price of €78.30/t. Prices subsequently increased. As a result, on Friday, October 10, these futures reached their maximum weekly settlement price of €79.69/t. According to data analyzed by AleaSoft Energy Forecasting , this price was 0.7% higher than the previous Friday and the highest since February 15.