The first auction under the Energy Services Capacity Storage Mechanism (MACSE) concluded with the allocation of 10 GWh of capacity in lithium-ion battery systems.

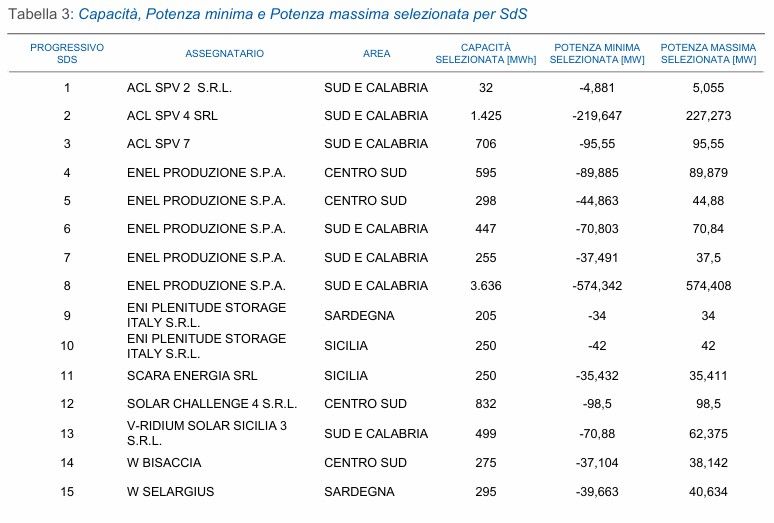

In total, 15 projects were awarded across Southern Italy, Calabria, Sicily and Sardinia, representing an estimated investment of €1 billion. The winning companies include Enel, Acl Energy, Renewable AdVenture, Whysol, GreenVolt Power, Eni and NatPower.

The weighted average closing price was €12,959/MWh-year, with lows in Southern Italy and Calabria (€12,146/MWh-year) and highs in Sicily (€15,846/MWh-year), well below the reserve price of €37,000/MWh-year.

The results of the auction demonstrated strong competition and significant market interest, as confirmed by Giuseppina Di Foggia, CEO of Terna.

Despite the sector being surprised by such low prices, the explanation offered regarding the profitability of many awarded projects is that, with a duration of 4 hours, the key lies in how MACSE revenues are combined with adjustment services.

Terna pays a fixed annual premium per installed MWh, but each day also defines operations and, in the hours prior to dispatch, there is the possibility of rescheduling the battery to participate in adjustment markets (secondary reserve, tertiary reserve or technical constraints). The additional benefits derived from this flexibility are shared between the plant optimiser and Terna.

According to battery consultant Andrés Pinilla Antón, this mechanism turns the MACSE premium into a stable income base, while the true attractiveness for developers lies in maximising profitability through those complementary services.

Nevertheless, speaking to Strategic Energy Europe, he remarked: “If these are the figures, it is not attractive for an independent producer to enter the auction and commit long term.”

He calculated that the nearly €13,000/MWh-year awarded equates to around €35/MWh per cycle with daily operation: “I do not see how these prices can be profitable in such a short period of time,” when greater returns could be achieved by opting for the merchant model and leveraging all the revenue streams available to batteries, from arbitrage to balancing services in the market.

This perspective is reinforced by consultancy Our New Energy (ONE). In a report entitled “ITA BESS | Beyond MACSE: Alternatives Available for Italian BESS Investors”, it is noted that beyond the auction, the merchant model remains robust, supported by two revenue streams: arbitrage in Day Ahead and Intraday markets, which can generate up to €60/MWh per cycle in the early years depending on the market zone, and ancillary grid services, increasingly in demand in a system with high renewable penetration.

In this first MACSE round, projects had to hold full construction and operation permits (including water-use concessions where applicable), free from judicial suspensions.

Bidders were required to post pre-auction guarantees and submit zone-specific offers expressed as annual premiums (€/MWh-year) for 15-year capacity contracts, capped by a regulatory maximum.

Eligible assets in this round were lithium-ion BESS connected in Southern Italy, Calabria, Sicily and Sardinia, with delivery expected by 2028 and subject to Terna’s operational rules on availability and performance.

The awarded companies show solid track records in storage. Enel leads with one of the largest BESS portfolios in Italy, including partnerships to scale financing and emblematic projects such as the second-life system at Rome-Fiumicino.

ACL Energy, together with BW ESS, has built a pipeline of almost 3 GW in the country, with projects aimed both at MACSE in the South and the capacity market in the North. Whysol manages around 864 MW of authorised projects and works with external investors on advanced revenue strategies.

To these actors we add GreenVolt, which through its Italian subsidiary seeks to integrate BESS into the commercial and industrial segment, and Eni/Plenitude, which in addition to winning capacity in the auction is driving an industrial initiative in Brindisi to manufacture LFP batteries.

Finally, NatPower and Renewable AdVenture emerge as developers with active portfolios in Southern Italy, aligned with the delivery timelines foreseen under MACSE.