Spain stands at a decisive moment for the development of floating offshore wind. Despite having one of the strongest wind resources in Europe and a well‑prepared shipbuilding and port industry, no commercial offshore wind farms are yet operating.

The National Energy and Climate Plan (PNIEC) sets a target of 3 GW installed capacity by 2030, but one year after the approval of Royal Decree 962/2024 (September 2024), the ministerial order that will lay the foundations for the first auction has still not been published.

Industry associations warn that this chronic delay risks scaring off investment, costing jobs and missing the technological opportunity. According to the Spanish Wind Energy Association (AEE), up to 7,500 jobs and more than €2 billion per year of GDP could be lost if urgent action is not taken.

While waiting for the decision, here is a review of the main pre‑projects that could occupy Europe’s prime offshore sites – and their developers.

Canary Islands: spearheading the rollout

The Canary Islands are considered the favourites to inaugurate Spanish offshore wind. Planned capacity here exceeds 2 GW.

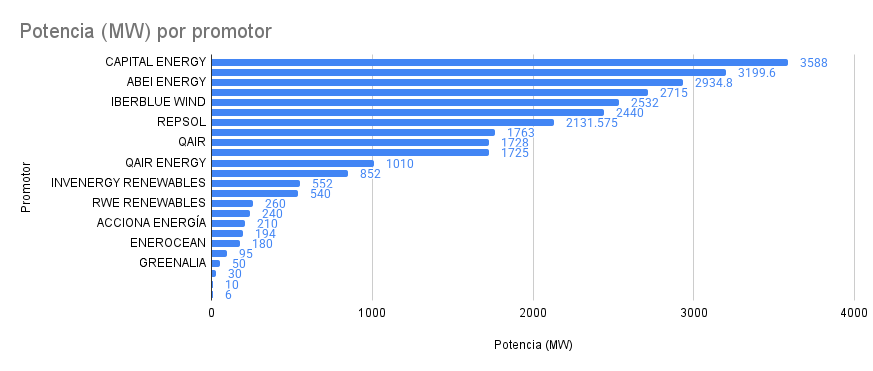

Key projects include Varuna (300 MW, ABEI Energy), San Borondón (283 MW, Iberdrola), Drago (260 MW, RWE), Maresía (254 MW, Capital Energy) and the two Canawind projects (250 MW each, Grupo Cobra).

Other schemes such as Andamana (240 MW, Magtel) and Tamaragua (236 MW, Qair Energy) are also in advanced stages.

Political and social support appears strong. AEE and the Offshore Wind Forum stress that “logically, the Canary Islands should be the spearhead” of Spain’s offshore rollout, given the high local electricity costs and consensus on the opportunity.

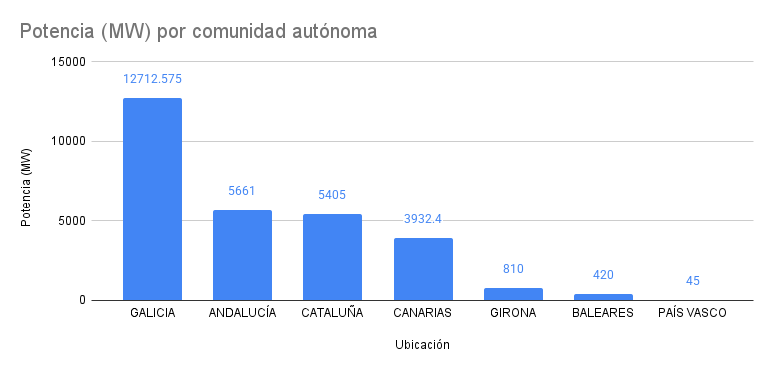

Galicia: the epicentre of development

Galicia holds the largest pipeline of projects and the most ambitious in size.

Standout developments include Ágata (1,200 MW, BlueFloat/Sener) and Galwind (1,000 MW, Cobra), along with other large‑scale plans such as Breixo (648 MW, Qair) and Repsol’s Atlántico series – e.g. Atlántico‑3 (645 MW).

Also on the list are Atlántico‑1 (525 MW, Repsol) and Ventus (600 MW, ABEI Energy), all currently in preliminary consultation or environmental assessment stages.

These farms are designed to harness the strong winds of the North Atlantic and supply the mainland grid. Galicia hosts several of the 19 marine zones defined as suitable in the official Marine Spatial Plans (POEM), together with the Canaries and other coasts, although local opposition remains significant.

Both the regional government and the private sector have urged national authorities to prioritise Galicia after the first pilot auction due to its resource potential and industrial base.

Galician port infrastructure is already gearing up: the outer port of A Coruña has reserved around 60 ha of yards (600,000 m²) for offshore wind projects, with development works expected to be completed by 2026.

Catalonia: the Mediterranean hub

In Spain’s Mediterranean waters, Catalonia hosts several major projects, mainly off the coast of Girona.

The largest is Catwind (1,200 MW, Cobra), already with administrative processing completed. Next come Norfeu (1,080 MW, Qair) in consultation and Tramuntana (1,000 MW, BlueFloat/Sener), also processed.

Other key projects include Xistral (810 MW, Capital Energy, off Girona) and two 525 MW parks: Mediterráneo‑1 (Repsol) and L’Empordà (Capital Energy), both recently filed.

There are also 500 MW initiatives such as Creus (Ferrovial) and Gavina (Iberdrola). All are within the POEM‑designated waters, but auction dates remain undefined.

Industry representatives underline that Catalonia’s industrial cluster is ready to invest but waiting for regulatory certainty. Repsol, for example, has filed Mediterráneo‑1 but insists it will not make a final decision until it knows “how the offshore wind regulation will ultimately be developed” and the auction design.

Andalusia: potential in the Atlantic and Mediterranean

Cádiz and Málaga coasts host projects such as Neptuno (1,005 MW, ABEI Energy), Nao Victoria and La Pinta (990 MW each, Iberblue). Complementary plans range between 500–600 MW, including Mileto (612 MW, Magtel), Terral (510 MW, Ferrovial), Albacín (510 MW, Capital Energy) and Almadraba (495 MW, Ferrovial).

Balearic Islands and other regions

In the Balearic Islands, two key initiatives stand out: Tramuntana Wind Menorca (240 MW, WTF Energy) and Gregal (180 MW, Qair Energy), both in early consultation stages.

Their scale is modest compared with the rest of Spain. In the Basque Country and Cantabria, activity is focused on demonstration projects such as Saitec’s DemoSATH platform (45 MW, GEROA in Biscay), with no commercial parks yet planned.

The major bottleneck: regulation

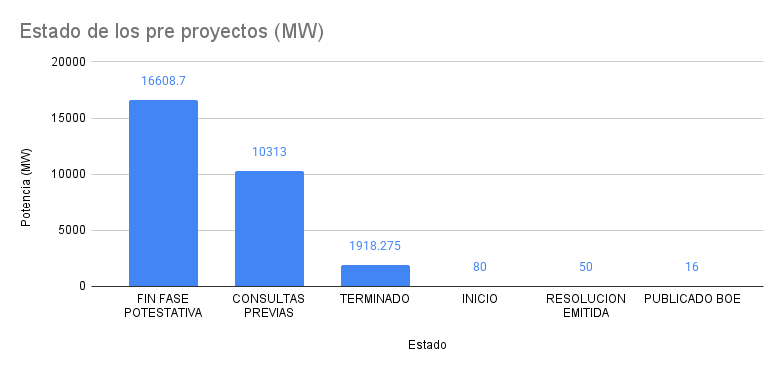

Spain’s offshore wind pipeline exceeds 28 GW, well above the 3 GW goal for 2030. The opportunity is historic to generate jobs, attract investment and consolidate the shipbuilding and port industry.

However, the window of opportunity is narrowing: the Government must accelerate publication of the ministerial order and call the first auctions if it wants these projects to move from paper to sea before it is too late.