In the first week of September, solar photovoltaic production increased in the French, Italian, and Spanish markets compared to the previous week, reversing the downward trend of recent weeks. The French market recorded the largest increase, 6.3%, while the Spanish market saw the smallest increase, 1.1%. Italy saw an increase of 4.7%. In contrast, the Portuguese and German markets saw consecutive declines in generation using this technology for the second and third consecutive weeks. Portugal recorded the largest drop, 14%, while Germany reduced its production by 5.1%.

During the week, major European markets reached historic records for solar PV production for a September day. This happened on Thursday, September 4, in the Spanish market, with a generation of 192 GWh. A day later, on Friday, September 5, the French and Portuguese markets recorded 131 GWh and 23 GWh, respectively, their highest daily generation figures with this technology in September. Finally, on Saturday, September 6, the German market reached 361 GWh and the Italian market 132 GWh of solar PV production on a September day.

For the second week of September, AleaSoft Energy Forecasting ‘s solar production forecasts anticipate an increase in solar photovoltaic generation in the Spanish market and declines in the German and Italian markets.

In the week of September 1, wind power production increased in most major European markets compared to the previous week. Germany recorded the largest increase, 60%, followed by 38% in France, which recorded two consecutive weeks of growth. Spain recorded the smallest increase, 26%, extending its growth for the third consecutive week. In contrast, the Portuguese and Italian markets reduced their wind power generation. Portugal recorded the largest drop, 15%, while Italy recorded two consecutive weeks of declines and cut its production by 6.7%.

For the week of September 7, AleaSoft Energy Forecasting ‘s wind energy production forecasts point to declines in the main European electricity markets.

Electrical demand

During the first week of September, electricity demand increased in most major European markets compared to the previous week. The British market recorded the largest increase, 7.2%, due to the recovery in demand following the Summer Bank Holiday on August 25. The German, Italian, and Portuguese markets posted increases of 1.7%, 2.1%, and 3.9%, respectively. Germany and Portugal continued their upward trend for the second consecutive week, while Italy accumulated three weeks of growth. The Belgian market showed the smallest increase, 0.8%, and maintained the upward trend for the sixth consecutive week. In contrast, the French and Spanish markets reduced their demand by 0.3% and 1.6%, respectively.

Average temperatures were lower than the previous week in all markets analyzed. Great Britain, Italy, Portugal, and Spain recorded the largest drops, ranging from 1.3°C in Great Britain to 1.7°C in Spain. Belgium, Germany, and France recorded the most moderate drops, of 0.3°C, 0.8°C, and 0.9°C, respectively.

For the week of September 8, AleaSoft Energy Forecasting ‘s demand forecasts indicate declines in demand in the Spanish, German, Portuguese, Belgian, and French markets, while the British and Italian markets will register increases.

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting with data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

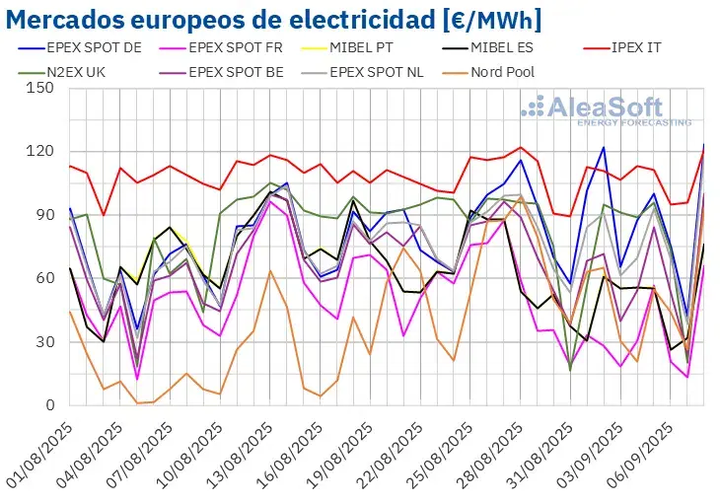

European electricity markets

In the first week of September, the average prices of the main European electricity markets fell compared to the previous week. The Nord Pool market in the Nordic countries and the EPEX SPOT market in France recorded the largest percentage price drops, of 38% and 48%, respectively. In contrast, the IPEX market in Italy and the EPEX SPOT market in Germany recorded the smallest price declines, of 3.1% and 5.9%, respectively. In the rest of the markets analyzed by AleaSoft Energy Forecasting , prices fell between 7.7% in the N2EX market in the United Kingdom and 31% in the MIBEL market in Spain and Portugal.

In the week of September 1, weekly averages were below €75/MWh in most European electricity markets. The exceptions were the German and Italian markets, whose averages were €84.90/MWh and €106.46/MWh, respectively. The French market recorded the lowest weekly average, at €28.79/MWh. In the rest of the markets analyzed by AleaSoft Energy Forecasting , prices ranged from €43.61/MWh in the Nordic market to €74.46/MWh in the British market.

Regarding daily prices, on some days in the first week of September, the Belgian, British, Spanish, French, Nordic, and Portuguese markets recorded daily prices below €30/MWh. On Sunday, September 7, the French market reached the lowest weekly average among the markets analyzed, at €13.24/MWh. This price was the lowest in the French market since August 6. In the case of the Spanish and Portuguese markets, the price on Saturday, September 6, was €26.54/MWh, their lowest daily average since June 16.

In contrast, in the first week of September, the German and Italian markets recorded daily prices above €100/MWh on some days. On September 2, the German market reached its highest daily average of the week, at €122.09/MWh. This was its highest price since July 2. However, on Monday, September 8, the daily price was even higher in the German market, at €123.56/MWh.

During the week of September 1, the decline in weekly gas prices and the increase in wind energy production in most markets contributed to the decline in prices in European electricity markets. Furthermore, electricity demand fell in the Spanish, French, and Dutch markets, while solar production increased in Spain, France, and Italy.

AleaSoft Energy Forecasting ‘s price forecasts indicate that, in the second week of September, prices will rise in the European electricity markets, influenced by the drop in wind energy production. Furthermore, solar energy production will fall in Germany and Italy.

Brent, fuels and CO 2

Brent oil futures for the Front-Month on the ICE market reached their weekly high of $69.14/bbl on Tuesday, September 2. This price was the highest since August 2. Prices subsequently fell. As a result of the declines, on Friday, September 5, these futures registered their weekly low of $65.50/bbl. According to data analyzed by AleaSoft Energy Forecasting , this price was 3.8% lower than the previous Friday and the lowest since June 6.

Expectations of further production increases from OPEC+ and rising US crude oil stockpiles exerted a downward influence on Brent oil futures prices in the first week of September. On Sunday, September 7, OPEC+ agreed to continue increasing its production in October, albeit to a lesser extent than in previous months.

Regarding the settlement prices of TTF gas futures on the ICE market for the Front-Month period, they remained around €32/MWh during the first week of September. On Tuesday, September 2, these futures registered their weekly minimum settlement price of €31.77/MWh. However, on Thursday, September 4, they reached their weekly maximum settlement price of €32.41/MWh. After a 1.4% drop compared to the previous day, on Friday, September 5, the settlement price was €31.97/MWh. According to data analyzed by AleaSoft Energy Forecasting , this price was still 1.1% higher than that of the previous Friday.

Abundant supply allowed TTF gas futures prices to remain around €32/MWh in the first week of September. European stockpile levels continued to rise, inching closer to the European Union’s 90% fill target for early November.

Regarding CO2 emission rights futures on the EEX market for the December 2025 reference contract, on Tuesday, September 2, they registered their minimum weekly settlement price of €73.61/t. Prices increased in the remaining sessions of the first week of September. As a result, on Friday, September 5, these futures reached their maximum weekly settlement price of €76.03/t. According to data analyzed by AleaSoft Energy Forecasting , this price was 4.2% higher than the previous Friday and the highest since February 18.