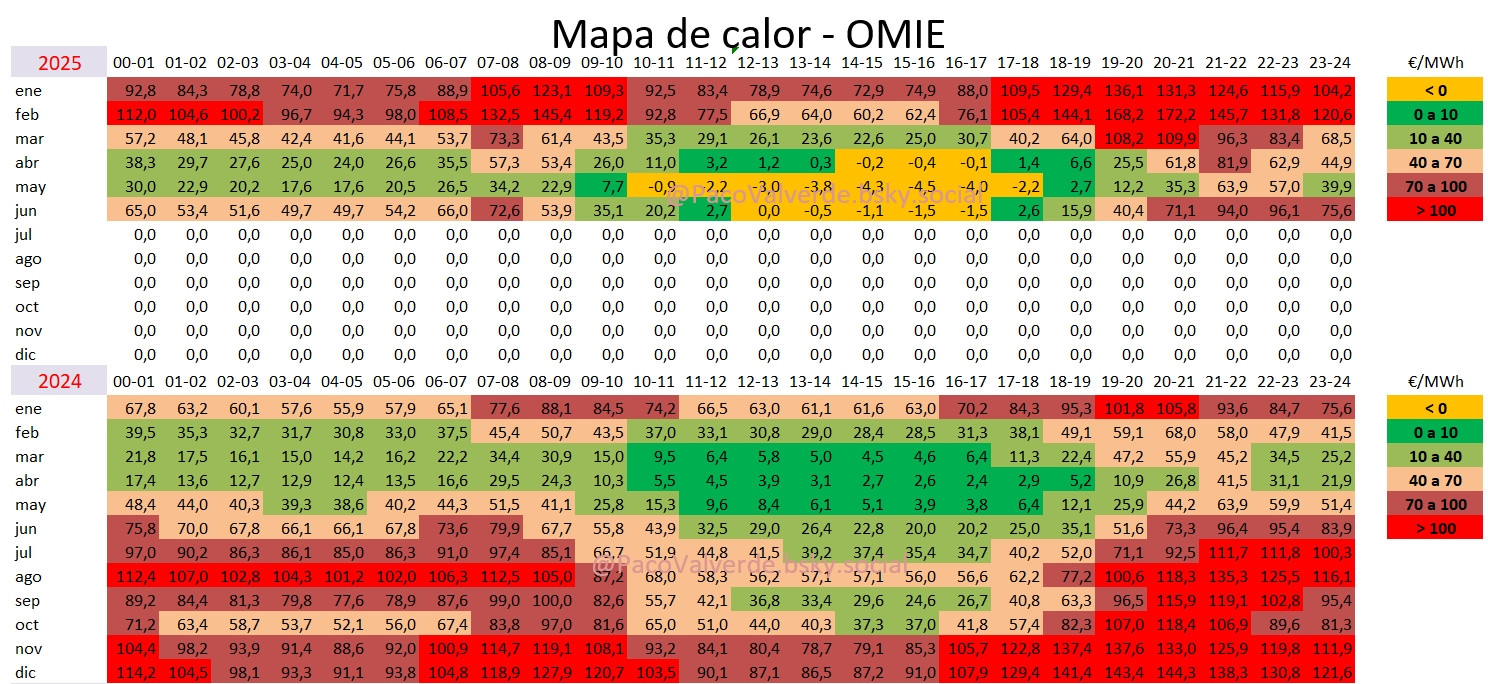

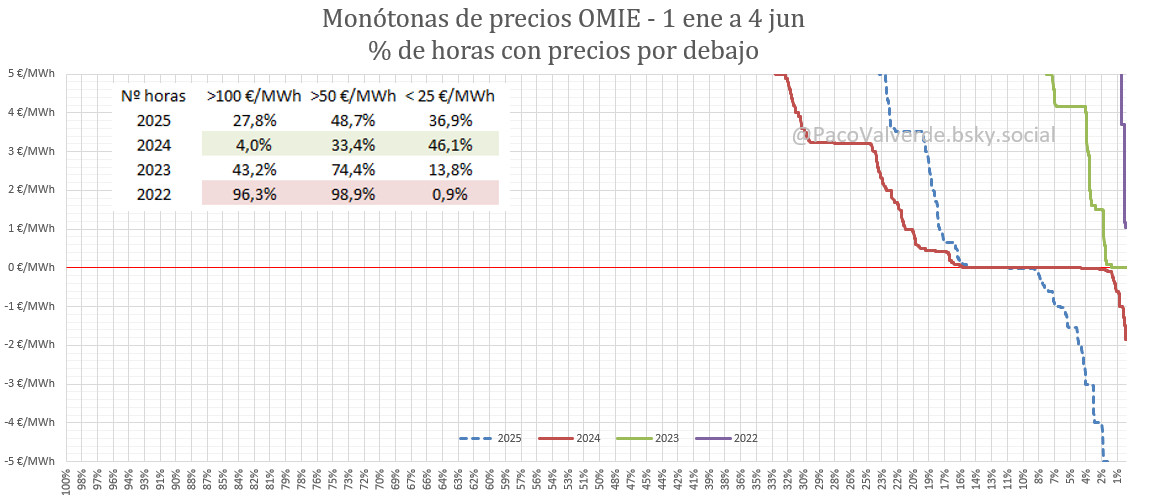

The Spanish electricity market closed May with an average of €16.93/MWh, setting a new historical low. This figure reflects a structural distortion in the price system that directly affects the economic viability of renewable technologies.

According to energy markets analyst Francisco Valverde, downward price pressure is the result of a convergence of well-known factors: massive photovoltaic generation during the same hours of the day, limited system flexibility, and weak demand.

In May, there were eight hours of negative pricing, more than double those recorded in April, with values dropping to –€15/MWh on four occasions. Solar generation, which led alongside hydro and wind, fell slightly short of its 2023 peak.

A significant portion of the energy not dispatched was not due to technical constraints, but rather to economic curtailment: offers that failed to clear in the day-ahead market.

Low demand further amplifies the downward pressure on prices. Although a slight rebound was observed towards the end of May, it was not enough to offset the structural imbalance.

REE estimated demand at 103,067 GWh between January and May 2025—just 0.3% higher than the same period in 2024, once adjusted for temperature and calendar effects—confirming a very modest recovery in electricity consumption.

Adding to the problem is the lack of incentives for storage. Despite 26 GW of battery capacity currently in permitting, Spain has only 50 to 56 MW in operation. With no regulation to support bankability and no clear signals from the capacity market, storage deployment remains sidelined.

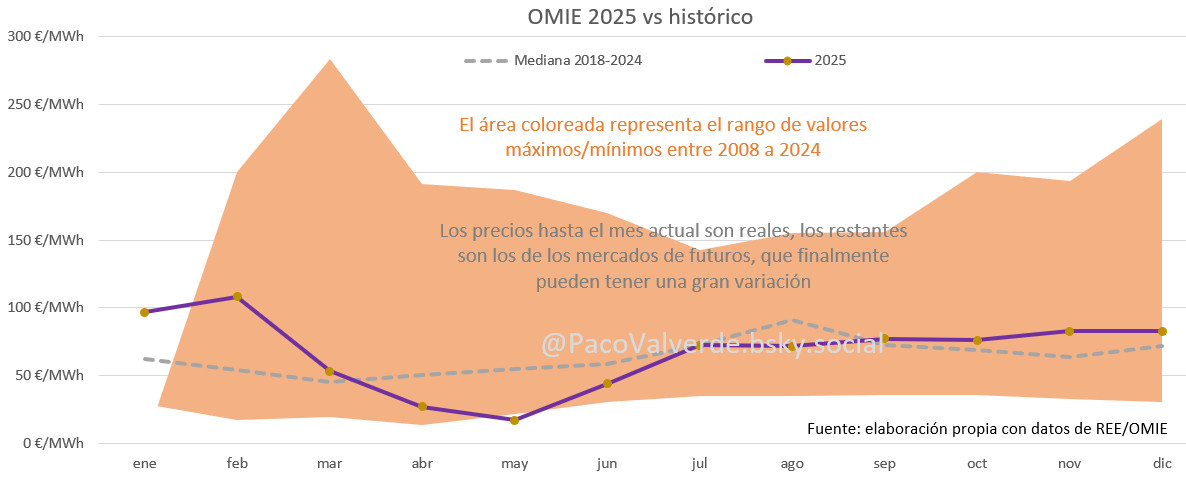

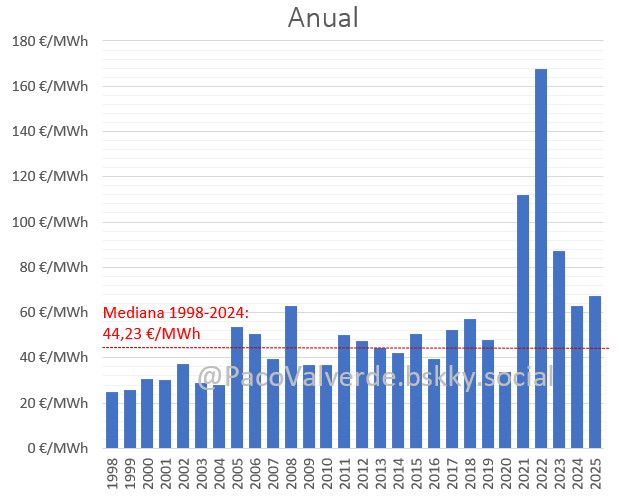

Gas remains the other central player in price formation. Combined-cycle plants generated 2.8 TWh in May, exceeding the average for this month over the past five years. This share, combined with the high cost of gas in Europe (TTF), explains why, despite the dominance of renewables, the annual average price remains high. If this trend continues, 2025 could end as the fourth most expensive year on record, with an estimated average of €67.4/MWh.

Hydropower, on the other hand, delivered extraordinary performance. With 4.2 TWh generated, May saw the highest hydro production since 2016. Reservoir levels remained at record highs throughout the month, and the post-blackout grid reinforcement boosted dispatchability.

The combined contribution of hydro, solar and wind brought the renewable share of mainland generation to 64%, with the annual average at 61%, similar to 2024 levels.

However, as Valverde points out in conversation with Strategic Energy Europe, market signals do not necessarily reflect this level of participation. Non-acceptant bidding strategies by major generators further distort the marginal price.

Endesa maintained its price “step” at €35/MWh, while Iberdrola adjusted its bids: wind from €3.2 to €3.5/MWh, and solar from €0.43 to €0.65/MWh. While the volume of these steps has been reduced, their pricing has increased, impacting the final market curve.

This kind of market positioning underscores the market power held by certain players. “A single company controls 50% of hydro capacity,” notes the analyst. The lack of real competition in certain segments allows these companies to set prices that do not align with marginal cost, undermining the efficiency of the overall system.

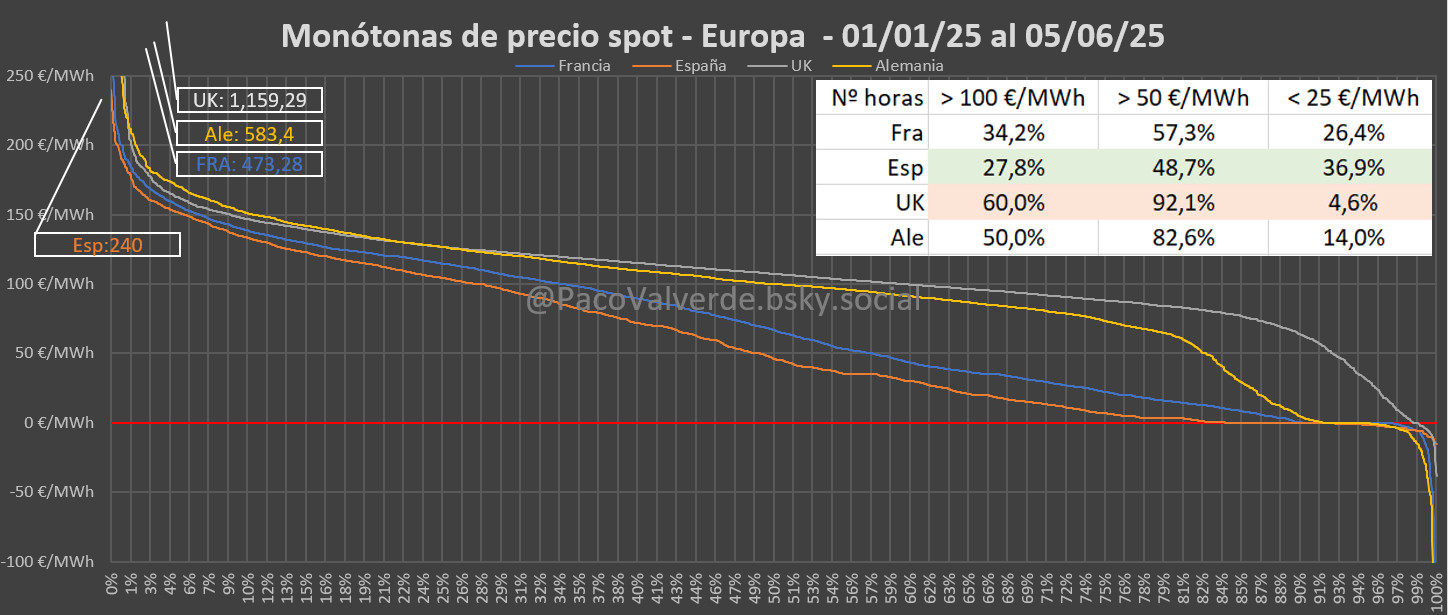

Despite these distortions, Spain still shows lower prices across all segments compared to its European counterparts. “We’re coming out ahead across the full price range,” says the consultant, referencing extreme situations in markets like Germany, where prices fall below –€500/MWh and rise above €1,000/MWh.

In this context, Valverde is unequivocal: from now on, hybridisation is essential. The integration of storage and active management of generated energy is becoming indispensable for maintaining profitability.

The investment model must evolve towards solutions that combine renewable generation with operational flexibility. “It’s no longer enough to rely on the acceptant price—you need to operate in intraday, continuous markets and with guarantees of origin,” he explains. This shift demands technical expertise and active commercial strategy.

A New Stage: The Transition to 15-Minute Market Intervals

From June 2025, Spain’s electricity system will fully transition to 15-minute settlement intervals, in line with EU Regulation 2019/943, which requires market settlement to be aligned with this temporal granularity.

This structural shift will completely reorganise both the day-ahead and intraday markets into 96 quarter-hourly blocks per day, and will lead to the definitive removal of complex bids—a tool long used by Spanish agents to structure their offers around technical and economic parameters.

From this point on, market clearing in the day-ahead segment will be executed exclusively via the pan-European Euphemia algorithm, which does not support complex bidding structures previously used in Spain.

This requires all system participants to adjust their commercial strategies, operational tools, and forecasting systems. While the reform aims to improve the accuracy of renewable energy representation in market bidding, it also increases exposure to financial imbalances for those who fail to adapt their operations promptly.

“It will be interesting to see how this measure actually affects day-ahead clearing. It may improve the way renewables are represented and give us more precise price signals,” concludes Valverde.