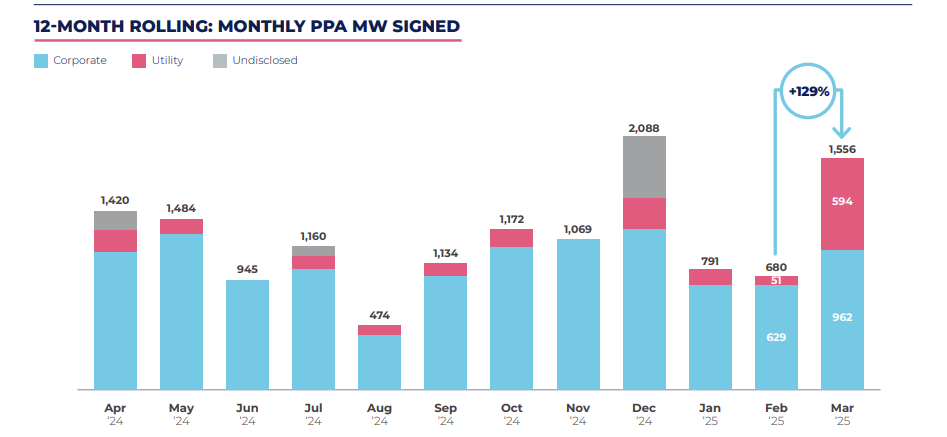

The European PPA market is showing signs of recovery after a modest start to the year. According to the report published by Pexapark in April 2025, 1,556 MW of new agreements were signed during the month of March, distributed across 24 public contracts. This figure represents a 129% increase compared to February, breaking the downward trend that characterized the start of 2025.

62% of the signed volumes came from corporate PPAs, reaching 962 MW, while contracts with utilities climbed to 594 MW, more than double the previous month. Although the number of agreements remained stable, the average size of each contract grew significantly.

Spain leads in volume with 686.9 MW, signed from six contracts, followed by Italy with 380 MW from four firms, and Poland with 152 MW from two PPAs.

Price Evolution: Widespread Decline in European Markets

In contrast to the rebound in contracts, PPA prices continued their decline in March, extending the downward cycle that began in February. The Pexapark EURO Composite index closed the month at 49.5 EUR/MWh, 1.4% less than in February.

Among the most affected markets, Poland registered a 4.8% drop, impacted by a drop in future energy prices and a sharp increase in monthly solar generation, which increased by 80% to 1.7 TWh. Italy, meanwhile, posted a 2.8% drop, influenced by the decline in gas prices for Cal26 and Cal27 contracts.

Portugal (-2.4%), Spain (-2.3%), France (-1.7%), and Germany (-0.4%) also registered declines, while only Germany (1.4%) and the Netherlands (1.0%) closed the month with increases in their PPA prices.

Leading Companies: Major Contracts in Spain, Italy, and France

Spain led the March volumes with 686.9 MW across six deals, highlighted by an intra-group transaction by Enel, which sold 49.99% of its subsidiary EGPE Solar to Masdar, maintaining PPAs for 446 MW of solar energy for 15 years.

In Italy, Edison Energia signed two large-scale agreements: one with Prysmian to supply from a 150 MW plant, and another with Data4, which contracted a baseload supply of 50 GWh per year from a 148 MW asset. These contracts are the largest signed in the country for a single asset, breaking the national average of 39 MW per agreement.

France, meanwhile, had the first public PPA of the year. A consortium led by Nantes Metropole, along with other entities such as SEMITAN and SEMINN, contracted 43 GWh/year through two agreements with Valoren and EnR 44, covering wind and solar generation in the west of the country.

Technologies: Solar PV Dominates the Market

Solar technology was the main player, accounting for 1,389 MW of the total signed in March (89%) across 17 agreements. Onshore wind energy participated with 139 MW across four contracts.

In the first quarter of 2025, Europe signed 3,026 MW across 73 agreements, below the 4,279 MW recorded in the same period in 2024. However, March marked a turning point, with a monthly average of 1,008 MW, which, although still 30% lower year-on-year, offers a glimpse of a possible recovery.

Regulation: The European Commission proposes new incentives for 24/7 PPAs

One of the report’s main focuses is the analysis of a new instrument being evaluated by the European Commission within the framework of the Clean Industrial Deal: the so-called “Clean Flexibility Instrument,” aimed at incentivizing clean, flexible, and continuous electricity consumption by industrial corporations.

The proposal envisions national auctions where companies will compete for subsidies, committing to consume 100% renewable electricity 24 hours a day for 15 years, either through PPAs with time-matching or consumption shifting through storage.

The initiative aims to strengthen the role of 24/7 PPAs, Demand Side Response (DSR), and storage systems (BESS) as part of an integrated sustainability strategy.

However, criticism has emerged from the industry over the requirement for full compliance from the outset. One aluminum industry company estimated that operating a single furnace under these parameters would cost more than €22 billion, and noted the lack of certification standards to validate it.

Conclusion

March is consolidating as the month of recovery for the European PPA market, with strong participation from the corporate sector, clear dominance of solar energy, and firm signs of progress in new regulations aimed at clean, continuous, and flexible consumption.

Spain, Italy, and Poland are leading the recovery, while prices continue to decline, reflecting the downward pressure of energy markets. The advancement of proposals such as the clean flexibility instrument aims to strengthen the strategic role of PPAs in the European industrial energy transition.